Press release -

Testing times ahead for fuel fraudsters

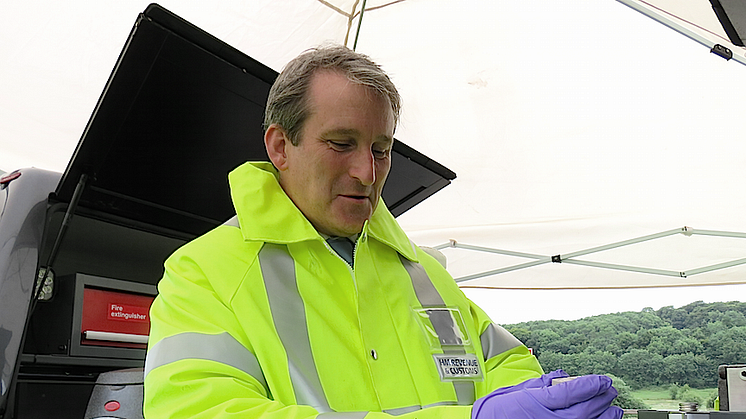

Treasury Minister Damian Hinds visited Belfast and Newry today as HM Revenue and Customs (HMRC) unveiled new roadside fuel testing equipment to tackle the trade in illicit diesel.

The hi-tech equipment has been introduced to allow officers to test vehicles at the roadside for the presence of the new fuel marker, which was introduced into supplies intended for use in agriculture and construction industries in April. The new marker is resistant to laundering techniques known to be used by criminal gangs and significantly improves HMRC's capability to detect fraud.

Previously, the test for the new marker was completed at a laboratory, leading to a delay in identifying illicit fuel and further action being taken. The new equipment will now be installed in 49 HMRC Road Fuel Testing Unit vehicles throughout the UK and used to analyse fuel samples taken at the roadside and at retail premises, starting in Northern Ireland.

Exchequer Secretary to the Treasury, Damian Hinds, said:

“I am delighted to see first-hand the new roadside testing equipment in action. Together with the new marker it will play an important part in the fight against fuel fraud.

“At a time when the government’s priority is cutting the deficit, it is unacceptable that criminals are cheating the system. The new marker and testing equipment are part of the significant investment we have made in HMRC to tackle avoidance, evasion and fraud to make sure all businesses and individuals contribute to the tax revenue that is used to fund vital public services.”

Illicit diesel is estimated to make up 13 per cent of the market share of diesel in Northern Ireland and costs the taxpayer around £80 million each year in lost taxes.

The government will monitor the success of the marker during the first six months, to make sure it is delivering results in the fight against fuel fraud. HMRC will publish an evaluation in the autumn.

Notes for editors

1. From 1 April the UK has introduced a new fuel marker which is significantly more resistant to laundering than the current markers.

2. HMRC fights fuel fraud on a wide range of fronts, from specialist units performing thousands of roadside checks to raiding laundering plants. This new marker will be a vital tool in the continuing fight against fuel fraud and organised crime.

3. During a rigorous joint UK/Ireland evaluation, the chosen marker proved significantly more effective than the previous markers on the basis of laboratory testing. This testing found that it was highly resistant to known laundering techniques.

4. A key element of the new marker is a ground-breaking portable analyser that allows quick and accurate roadside testing. The first Road Fuel Testing Unit (RFTU) vehicle has been successfully fitted with this new analyser and six such vehicles should be operating in NI by the end of the summer. It is planned that the entire UK RFTU fleet of 49 vehicles will be fitted with the new roadside analyser by early 2016.

5. Launderers primarily target red or green diesel, filtering it through chemicals including acids to remove the marker. These remain in the fuel and damage fuel pumps in diesel cars.

6. Although red diesel is predominantly targeted, launderers may also seek to remove the marker from other rebated fuels – especially kerosene primarily used for heating oil.

7. For UK red diesel, excise duty is charged at 11.14 pence per litre instead of the full rate of 57.95ppl. Excise duty on kerosene, used for heating, (which will also have the marker added to it) has a zero duty rate. Rebated fuel is marked with dye and chemical markers so that its use for any other purpose or illegal sale can be identified.

Topics

Categories

Regions

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.