Press release -

UK tax gap falls to 6.4 per cent

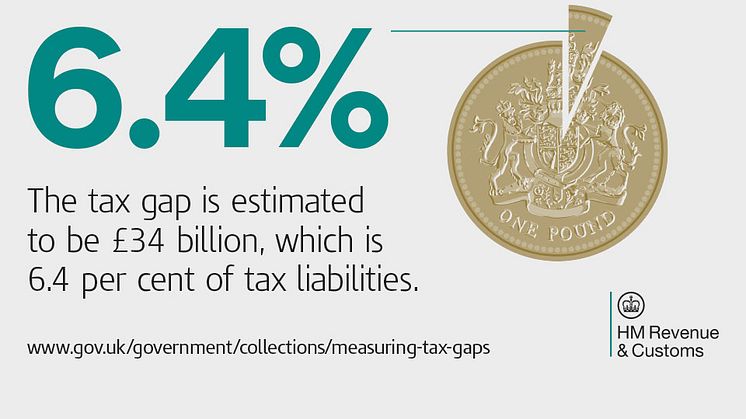

The tax gap for 2013-14 was 6.4 per cent of tax due, continuing a long-term downward trend, reflecting that HM Revenue and Customs’ (HMRC) approach is delivering steady, and sustained progress.

The tax gap, which is the difference between the amount of tax due and the amount collected, has fallen from 8.4 per cent in 2005-06, annual figures released today by HMRC show.

This reduction in the percentage tax gap since 2005-06 represents an additional £57 billion in cumulative tax collected over the eight-year period.

The largest reduction is in the Corporation Tax gap which has halved since 2005-06, from 14 per cent to 7 per cent of relevant tax liabilities. There has been a sustained downward trend for both large and small businesses, with the overall reduction driven mainly by large businesses.

David Gauke, Financial Secretary to the Treasury, said:

“The UK has one of the lowest tax gaps in the world, and this Government is determined to continue fighting evasion and avoidance wherever it occurs.

“If the tax gap percentage had stayed at its 2009-10 value of 7.3 per cent, £14.5 billion less tax would have been collected.”

“There is understandable anger when individuals or companies are perceived not to be contributing their fair share, but we can reassure the public that the proportion going unpaid is low and this Government is dedicated to bringing it down further.”

Edward Troup, HMRC’s Second Permanent Secretary and Tax Assurance Commissioner, said:

“The long-term downward trend shows that our approach to non-compliance is delivering solid and sustained progress.

“We are committed to reducing the tax gap further and bringing in more money to fund vital public services. We are continuously looking for new ways to improve compliance and tackle non-compliance, whether by helping individuals do the right thing or by cracking down on offshore tax evasion by the wealthy or tax avoidance by multinationals.”

The Government invested almost £1 billion over the last Spending Review period to transform HMRC’s approach to compliance and close the tax gap. This investment contributed to the delivery of more than £100 billion in additional compliance revenues over the Spending Review period to the end of 2015-16.

On top of this, at the Summer Budget, the Chancellor announced a range of new measures including £800 million of investment over the parliament, to strengthen HMRC's ability to tackle evasion, reduce avoidance and improve voluntary compliance, including using data to identify and tackle tax risks more effectively.

In 2013-14, HMRC brought in £505.8 billion in tax revenue for public services and secured £23.9 billion of compliance yield – money that would otherwise have been lost to the Exchequer. HMRC has built on this and last year (2014-15) brought in a record £517.7 billion in tax revenue and secured £26.6 billion in compliance yield.

Notes to editors

1. HMRC’s Measuring Tax Gaps 2015 and methodological annex documents are published on GOV.UK here: https://www.gov.uk/government/statistics/measuring-tax-gaps.

2. HMRC’s tax gap estimates are produced in accordance with the Code of Practice for Official Statistics, which assures objectivity and integrity. The methodology is judged by independent third parties to be robust, having been intensively scrutinised and given a clean bill of health by the International Monetary Fund and reviewed by the National Audit Office.

3. The tax gap estimates for 2012-13 and earlier years have been revised due to the inclusion of new data and methodological improvements.

4. Each year the tax gap is subject to revision due to:

- new or revised economic data

- new data on HMRC’s operations, such as audit cases settled and new data on tax at risk in legal challenges

- methodology changes that improve the estimate.

5. Information about HMRC’s record-breaking year in 2014-15 is available in the department’s annual report and accounts, published here: https://www.gov.uk/government/publications/hmrc-annual-report-and-accounts-2014-to-2015

6. Follow HMRC Press Office on Twitter @HMRCpressoffice.

7. Graphics related to HMRC's tax gap – including an at-a-glance infographic – are available on Flickr: http://www.flickr.com/hmrcgovuk

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.