Making Tax Digital for VAT pilot open for business

A pilot for a new online VAT service was launched today, with HM Revenue & Customs (HMRC) inviting more than half a million businesses to try it ahead of new rules coming into force in April 2019.

A pilot for a new online VAT service was launched today, with HM Revenue & Customs (HMRC) inviting more than half a million businesses to try it ahead of new rules coming into force in April 2019.

More than half a million businesses have signed up to an online tax account – Your Tax Account – HM Revenue and Customs (HMRC) announced today.

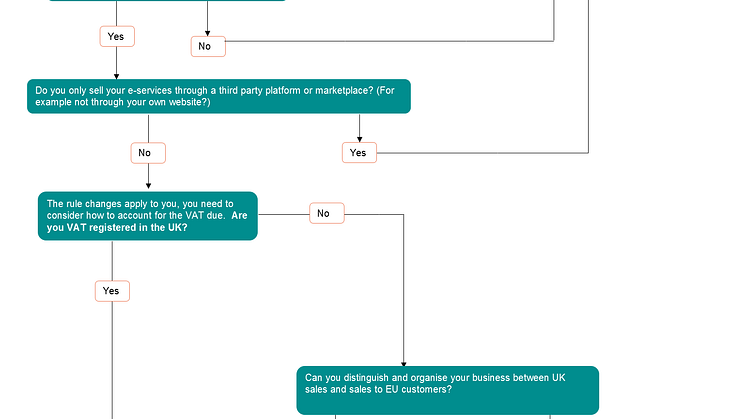

HM Revenue and Customs (HMRC) has published additional guidance [hyperlink] for UK micro and small businesses who supply digital services to consumers in other EU Member States.

VAT place of supply of services rules changes from 1 January 2015. HM Revenue and Customs (HMRC) held a Twitter Q & A on 27 November 2014. Here we list some of the main questions to come out of that.

A Fermanagh farmer, who was jailed for stealing nearly £500,000 in fraudulent VAT repayments, has been ordered to repay £60,000 or serve a further two years in prison.

A Co Armagh man has been arrested in connection with a suspected multi million pound VAT fraud, linked to the transport industry, after an investigation by HM Revenue and Customs (HMRC).

The tax gap, which is the difference between the amount of tax due and the amount collected, was 6.8% of tax liabilities, or £34 billion, in 2012-13.

A tax tribunal has backed HM Revenue and Customs (HMRC) in yet another tax avoidance case – this time against a university which claimed over £600,000 in VAT.

Businesses supplying digital services across the European Union will be able to register for a new online VAT service from 20 October.

A Co Tyrone farmer who tried to steal over £1.3 million in a VAT fraud has been jailed for 16 months after an investigation by HM Revenue and Customs (HMRC).

The Court of Appeal has ruled that a member of an online retail group must pay corporation tax on VAT repayments, in a judgment that could safeguard up to £800 million for vital public services.

Tax cheats in the North East who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.