VAT cheats crackdown

Tax cheats in Scotland and Northern Ireland who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

Tax cheats in Scotland and Northern Ireland who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

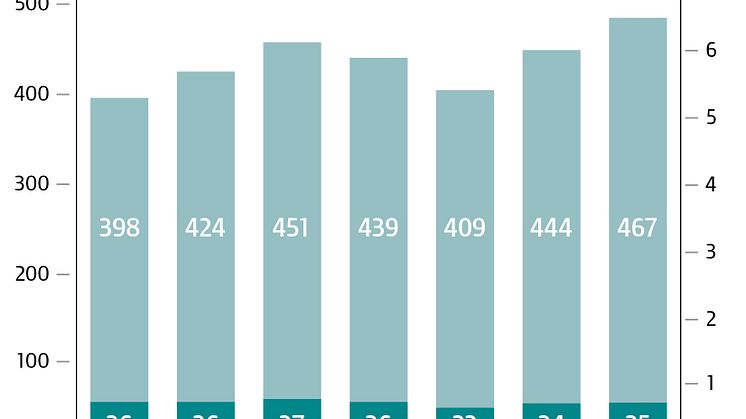

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2011-12 at 7 per cent (£35 billion) of tax due, continuing a long-term downward trend.

Under new regulations published today, for the first time schemes designed to get around the Annual Tax on Enveloped Dwellings will have to be disclosed to HM Revenue and Customs (HMRC).

Taxpayers who have failed to submit tax returns for past years have one week left to come forward and take advantage of an HM Revenue and Customs (HMRC) campaign.

People in the health and wellbeing professions who have taxable income that they have not told HM Revenue and Customs (HMRC) about are being targeted in a new campaign launched today.

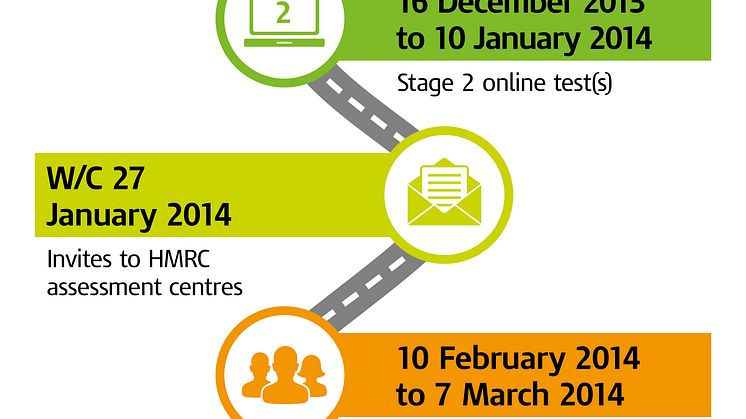

The search begins this week for at least 120 graduates to join HM Revenue and Customs (HMRC) as tax trainees.

Charities are being reminded that from 1 October they must make Gift Aid repayment claims using the Charities Online service.

Landlords who rent out residential property, and fail to tell HM Revenue and Customs (HMRC) about all the rental income, are being offered the chance to come forward and put their tax affairs straight – before HMRC comes to them.

Tax cheats in the private security industry are being targeted as part of the next wave of taskforces launched today by HM Revenue and Customs (HMRC).

More than 1.6 million employer PAYE schemes, covering over 40 million individual records, are already reporting in real time since the launch of new reporting requirements in April, and any employers who have failed to follow the new process have been urged to act now by HM Revenue and Customs (HMRC).

Higher income parents currently receiving Child Benefit have just four weeks to register for Self Assessment with HM Revenue and Customs (HMRC) in order to avoid a penalty.

A new crackdown on tax evasion will make information on all credit and debit card payments to UK businesses available to HM Revenue and Customs (HMRC) for the first time.