No tax relief for McLaren fine

Formula 1 racing giant McLaren has lost its claim that a £32 million fine imposed against it by the sport’s governing body should be tax deductible.

Formula 1 racing giant McLaren has lost its claim that a £32 million fine imposed against it by the sport’s governing body should be tax deductible.

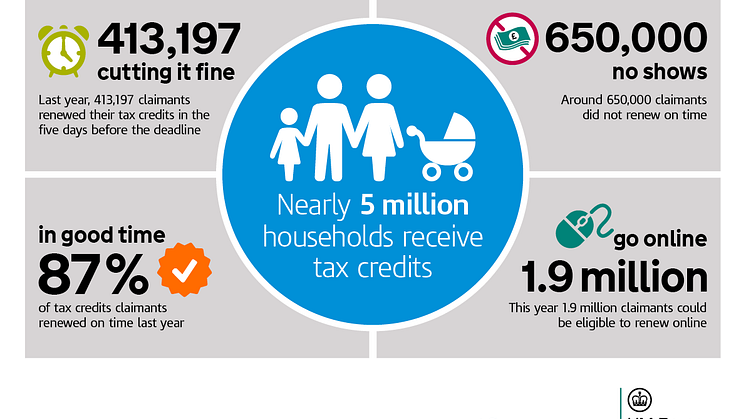

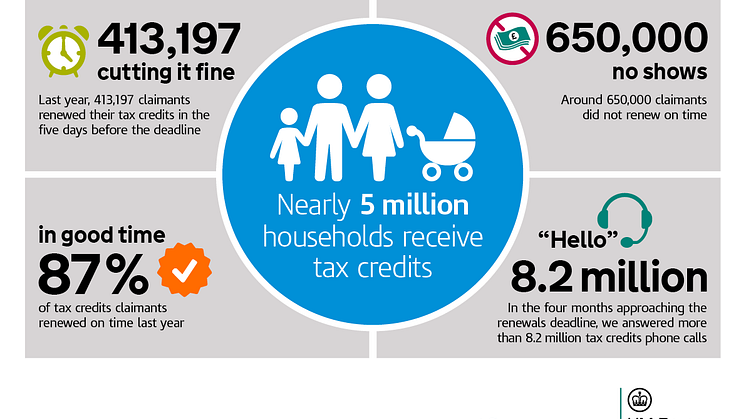

Tax credits claimants are being warned about scam or “phishing” emails sent out by fraudsters in the run-up to the 31 July renewal deadline.

The High Court has thrown out an attempt to challenge legislation introduced to tackle Stamp Duty Land Tax (SDLT) avoidance.

Businesses supplying digital services – broadcasting, telecoms and e-services such as smartphone games and other apps – across the European Union will be able to use a one-stop VAT service from January.

Over £4.6 million in wage arrears has been paid to more than 22,000 workers following a successful year for HM Revenue and Customs’ (HMRC) National Minimum Wage (NMW) enforcement teams.

Tax credits customers are being prompted, through an advertising campaign launched today, to renew their claim now.

Small and medium-sized high-tech companies are being invited to a free workshop in Glasgow on support available for business growth, research and development (R&D) tax credits and innovation. The event will be held on Wednesday 18 June at IET Glasgow, Teacher Building, 14 St Enoch Square.

A multi-million pound tax allowance claim made by one of the UK’s largest clothing retailers has been rejected for the second time by a tax tribunal.

New figures published today show that HM Revenue and Customs (HMRC) secured a record £23.9 billion in additional tax revenue over the last year as a result of increased activity to make sure people pay the taxes they owe.

Landlords are being offered online training in tax matters from HM Revenue and Customs (HMRC).

Another attempted abuse of the tax relief available when shares are gifted to charities has been blocked by a tribunal.

Another avoidance scheme designed by NT Advisors has been defeated at a tax tribunal. HM Revenue and Customs (HMRC) scored its fifth victory against schemes promoted by Matthew Jenner and his firm, bringing the total tax protected to more than £750 million. Recent defeats for the promoters include “Working Wheels”, where participants claimed to be second-hand car dealers.