Illegal filling station shut down in Lancashire

A diesel laundering plant and illegal filling station, capable of evading £14.5 million in duty a year, have been dismantled by HM Revenue and Customs (HMRC) in the Darwen area of Lancashire.

A diesel laundering plant and illegal filling station, capable of evading £14.5 million in duty a year, have been dismantled by HM Revenue and Customs (HMRC) in the Darwen area of Lancashire.

Today the government is taking further tough action to crack down on tax avoidance promoters.

Multinational corporations were hit with £1.1 billion in extra tax demands last year after HMRC successfully challenged the prices charged between companies in the same multinational group for goods and services.

The Court of Appeal today ruled in favour of HM Revenue and Customs against Eclipse Film Partners (No 35) LLP, protecting an estimated £635 million in tax.

Charities can now register their details online with HM Revenue and Customs (HMRC).

An HM Revenue and Customs (HMRC) spokesperson said:

"As the French Finance Minister confirmed, there were strict conditions under the terms of the agreement about the use of the HSBC Suisse data that the French tax authority shared with HMRC.

"Our records show that, since 2010, we have asked the French on several occasions for permission to use the data for purposes wider than tax, for exam

An online trial has been launched by HM Revenue and Customs (HMRC), allowing company car drivers to make changes to car and fuel benefits that will affect their tax codes.

More than eight million taxpayers who filed their 2013-14 tax return electronically by the 31 January deadline can now access their online tax summary.

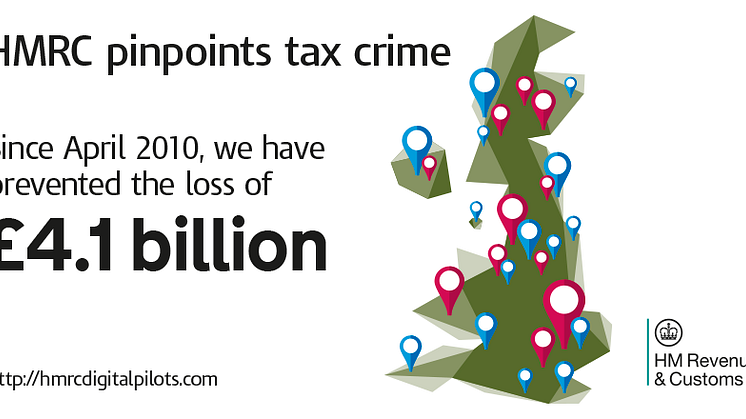

An online map pinpointing tax cheats around the country together with their crime and sentence has been launched today by HM Revenue and Customs (HMRC). The map allows people to see the impact of HMRC’s enforcement work.

HM Revenue and Customs (HMRC) welcomed the report by the National Audit Office published today, which recognised the progress the department has made over the past five years in increasing revenues, reducing costs and improving customer service.

HM Revenue and Customs (HMRC) oversaw the biggest digital Self Assessment event ever this year, receiving 10.24 million tax returns by midnight on 31 January – a record 85.5 per cent of which were sent online, it revealed today.

HM Revenue and Customs (HMRC) has today published the consultation paper, ‘Strengthening Sanctions for Tax Avoidance’, setting out proposals to tackle the serial use of tax avoidance schemes.