Self Assessment customers warned about scammers posing as HMRC

Self Assessment customers should be alert to criminals claiming to be from HM Revenue and Customs (HMRC).

Self Assessment customers should be alert to criminals claiming to be from HM Revenue and Customs (HMRC).

HM Revenue and Customs (HMRC) is reminding Self Assessment customers that there are just 100 days left to complete their tax return ahead of the deadline on 31 January 2021.

HM Revenue and Customs (HMRC) has received more than 54,800 claims from customers using a new online portal which allows workers to claim tax relief for working at home.

Students starting university this year are being warned by HM Revenue and Customs (HMRC) that they could be targeted by a fresh wave of tax scams.

Self Assessment customers can apply online for additional support to help spread the cost of their tax bill into monthly payments from today (1 October), without the need to call HM Revenue and Customs (HMRC).

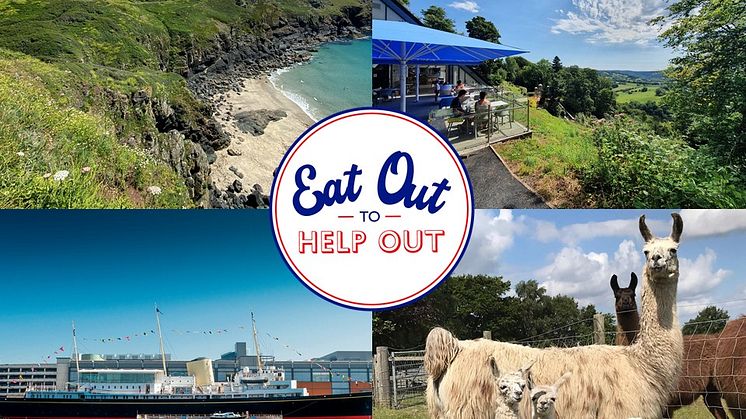

On top of mountains, on board a Royal Yacht and even sat amongst llamas – these are just some of the wild and wonderful places where you can enjoy the UK Government’s Eat Out to Help Out Scheme.

Millions of teenagers are set to benefit for the first time from money in Child Trust Funds (CTFs) that has been waiting for them since they were young children.

Families who benefit from government funded childcare support were given a boost today as the Government announced that they would not lose out due to COVID-19.

More than 53,000 outlets across the UK have so far signed up to the UK Government’s Eat Out to Help Out Scheme - and today a new official Government online finder is available to help diners locate them.

Tax credits customers have just one week left to tell HM Revenue and Customs (HMRC) about changes to their circumstances or income before the deadline on 31 July 2020.

Anyone who has difficulty paying their second 2019/20 Self Assessment payment on account can take advantage of automatically deferring the payment until 31 January 2021, HMRC is reminding taxpayers.

Restaurants and other establishments serving food for on premises consumption can now sign up to a new government initiative aimed at protecting jobs in the hospitality industry and encouraging people to safely return to dining out.