Self Assessment customers can help themselves by filing their tax return early

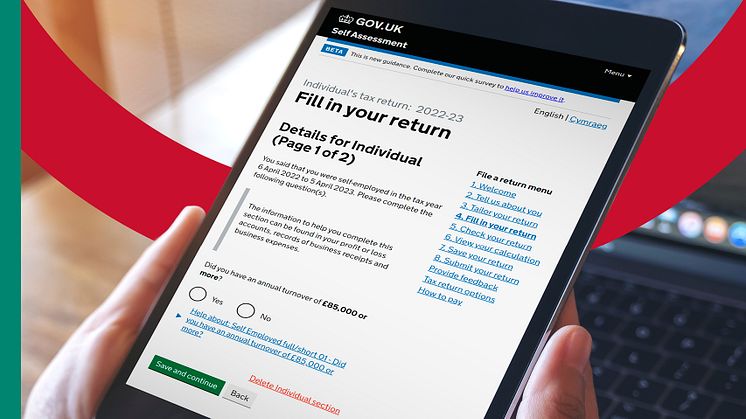

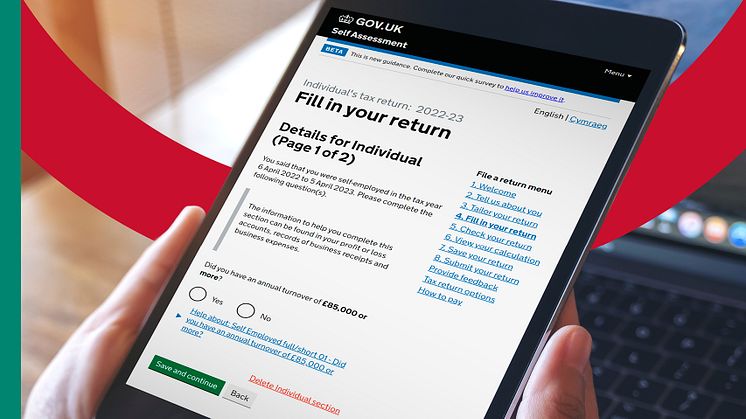

Self Assessment customers could take advantage of four key benefits when filing their tax return early, HM Revenue and Customs (HMRC) has revealed.

Self Assessment customers could take advantage of four key benefits when filing their tax return early, HM Revenue and Customs (HMRC) has revealed.

Almost 100,000 Self Assessment customers have used online payment plans to spread the cost of their tax bill into manageable monthly instalments since April 2021, HM Revenue and Customs (HMRC) has revealed.

HM Revenue and Customs (HMRC) is waiving late filing and late payment penalties for Self Assessment taxpayers for one month – giving them extra time, if they need it, to complete their 2020/21 tax return and pay any tax due.

HM Revenue and Customs (HMRC) is reminding Self Assessment customers to declare any COVID-19 grant payments on their 2020/21 tax return.

More than 2.7 million customers claimed at least one Self-Employment Income Support Scheme (SEISS) payment up to 5 April 2021. These grants are taxable and customers should declare them on their 2020/21 tax return before the deadline on 31 January 2022.

Th

More than 20,000 Self Assessment customers have used HM Revenue and Customs (HMRC) online monthly payment plan service since April to spread the cost of their tax bill, totalling £46 million so far, it has been revealed.

HM Revenue and Customs (HMRC) is reminding Self Assessment customers that on Sunday 24 October, they have one week left to submit paper tax returns and 100 days to go for online tax returns.

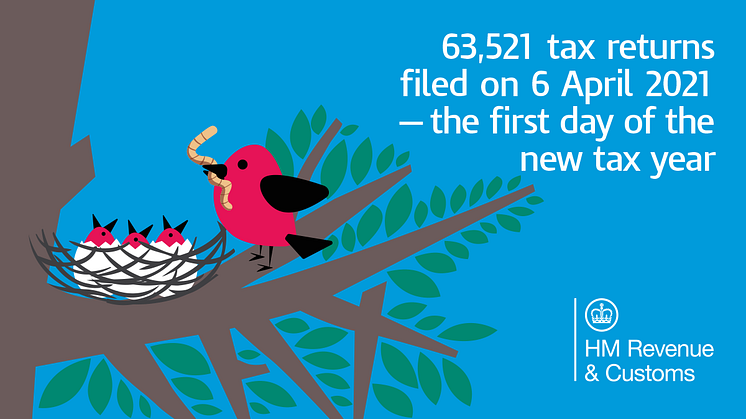

More than 63,500 customers filed their 2020/21 tax return online on 6 April, HM Revenue and Customs (HMRC) has revealed.

More than 264,000 individuals have opened a Help to Save account and could be earning money on their savings, statistics from HM Revenue and Customs (HMRC) have revealed.

Self Assessment taxpayers have less than one week to submit their late tax returns to prevent a £100 penalty, HM Revenue and Customs (HMRC) has urged.

More than 10.7 million people submitted their 2019/20 Self Assessment tax returns by the 31 January deadline, HM Revenue and Customs (HMRC) has revealed.

Self Assessment customers will not receive a penalty for their late online tax return if they file by 28 February, HM Revenue and Customs’ Chief Executive Jim Harra has announced.

Almost 25,000 Self Assessment customers have set up an online payment plan to manage their tax liabilities in up to 12 monthly instalments, totalling £69.1 million, HM Revenue and Customs (HMRC) has revealed today.