One million people renew their tax credits

Thousands of people have already used the tax credit online renewal service in the early hours of the morning, new statistics reveal today.

Thousands of people have already used the tax credit online renewal service in the early hours of the morning, new statistics reveal today.

Error and fraud in the tax credits system has been reduced to its lowest level since tax credits were introduced in 2003.

HM Revenue and Customs (HMRC) is urging people to renew their tax credits claim online as soon as possible ahead of the deadline in July.

Plans to recover tax and tax credit debts directly from the bank accounts of people and businesses who refuse to pay what they owe will include strong safeguards to protect vulnerable taxpayers, the government announced today.

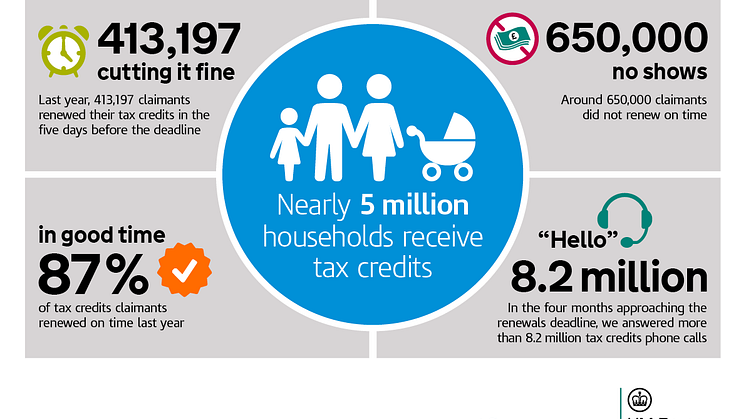

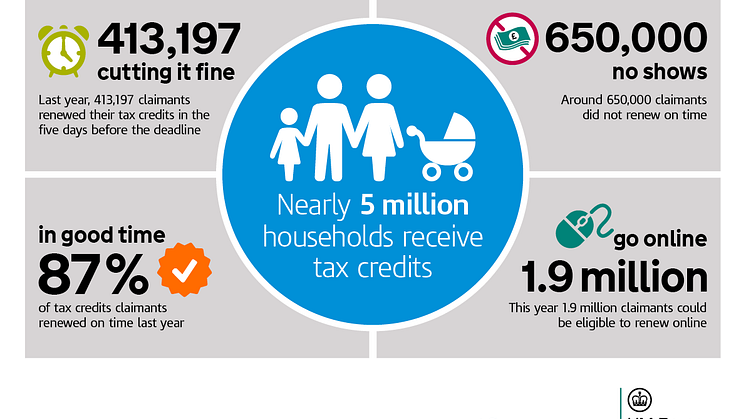

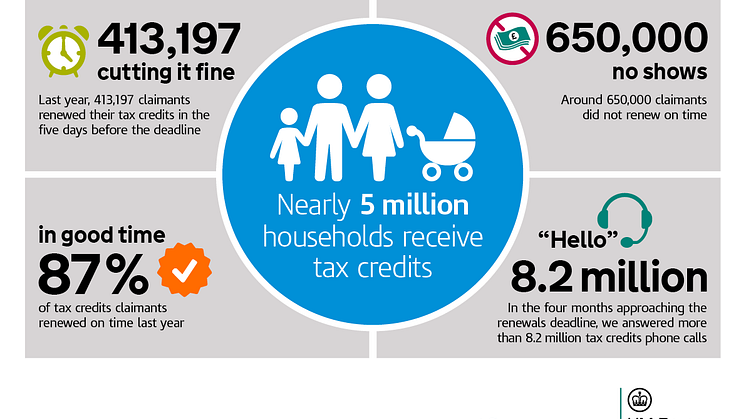

More than three million people renewed their tax credits on time, with many taking advantage of the new online option, HM Revenue and Customs (HMRC) announced today.

With the tax credits renewal deadline of 31 July just over two weeks away, HM Revenue and Customs (HMRC) has revealed the top 10 excuses for not renewing tax credits claims.

With the tax credits renewal deadline of July 31 less than one month away, HM Revenue and Customs (HMRC) has launched a new online service for the vast majority claimants to use.

Tax credits claimants are being warned about scam or “phishing” emails sent out by fraudsters in the run-up to the 31 July renewal deadline.

Tax credits customers are being prompted, through an advertising campaign launched today, to renew their claim now.

The 609,400 people who receive tax credits in London are being reminded by HM Revenue and Customs (HMRC) to renew early before the 31 July deadline to avoid a last minute rush.

Tax credits customers in Newcastle who are now living with a partner are being reminded to update their tax credits claim as HM Revenue and Customs (HMRC) launches a new campaign to reduce tax credits error and fraud.

Small and medium-sized high-tech companies are being invited to a free workshop in Reading on support available for business growth, research and development (R&D) tax credits and innovation. The event will be held on Thursday 3 April at the Palmer Building, Whiteknights Campus, Reading University.

100 Parliament St

SW1A 2BQ London