Remember, remember, it’s online from November

If you haven’t yet sent in your 2012/13 tax return, remember to do it online to avoid a penalty.

If you haven’t yet sent in your 2012/13 tax return, remember to do it online to avoid a penalty.

An offshore tax avoidance scheme used by an FTSE 100-listed investment management company to pay its employees tax-free bonuses has been closed by Scotland’s most senior court.

Unused Pay As You Earn (PAYE) schemes will be shut down, HM Revenue and Customs (HMRC) announced today.

There are just days left to send your 2012/13 paper tax return to HM Revenue & Customs (HMRC), if you want to beat the 31 October deadline and avoid a penalty.

HM Revenue and Customs (HMRC) has today opened discussions with the commercial sector about how it could help to reduce tax credits error and fraud. This follows a short trial earlier this year with a private sector supplier.

Tax cheats in Scotland and Northern Ireland who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

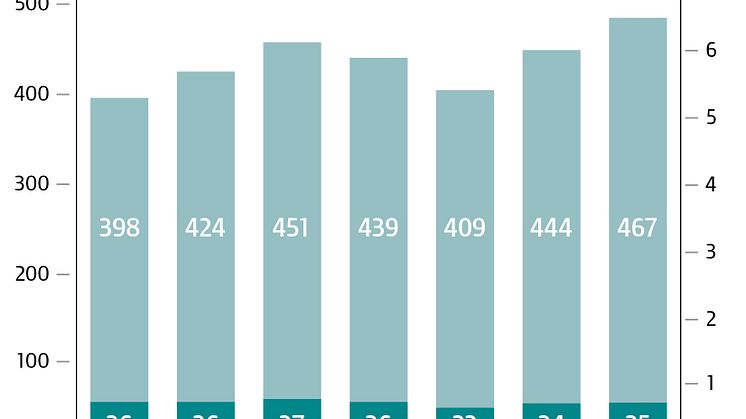

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2011-12 at 7 per cent (£35 billion) of tax due, continuing a long-term downward trend.

Under new regulations published today, for the first time schemes designed to get around the Annual Tax on Enveloped Dwellings will have to be disclosed to HM Revenue and Customs (HMRC).

Taxpayers who have failed to submit tax returns for past years have one week left to come forward and take advantage of an HM Revenue and Customs (HMRC) campaign.

People in the health and wellbeing professions who have taxable income that they have not told HM Revenue and Customs (HMRC) about are being targeted in a new campaign launched today.

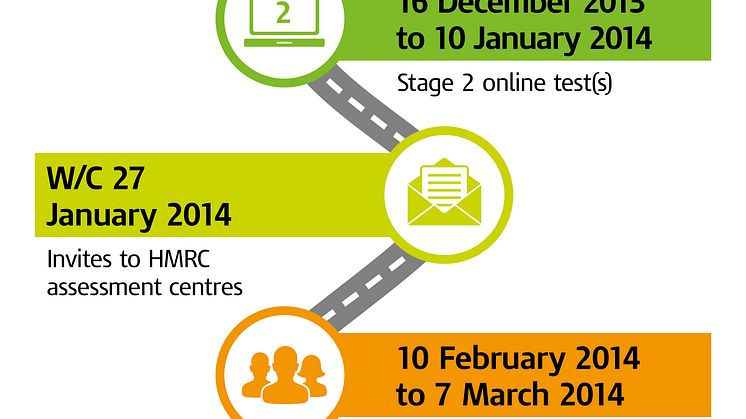

The search begins this week for at least 120 graduates to join HM Revenue and Customs (HMRC) as tax trainees.

Charities are being reminded that from 1 October they must make Gift Aid repayment claims using the Charities Online service.