HMRC statement on French Finance Minister remarks

An HM Revenue and Customs (HMRC) spokesperson said:

"As the French Finance Minister confirmed, there were strict conditions under the terms of the agreement about the use of the HSBC Suisse data that the French tax authority shared with HMRC.

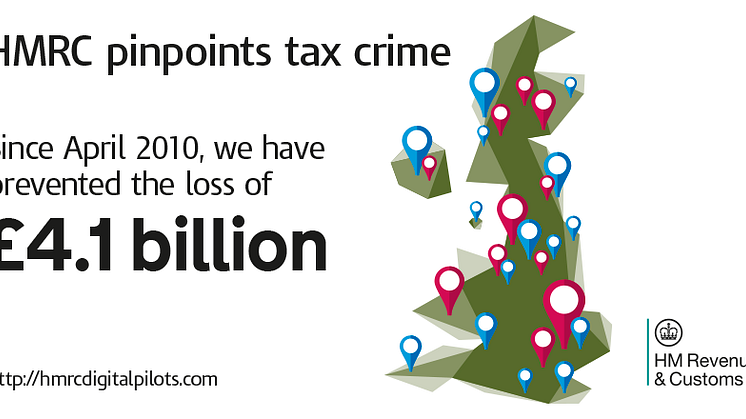

"Our records show that, since 2010, we have asked the French on several occasions for permission to use the data for purposes wider than tax, for exam