Less than one week to go for MTD

Businesses have less than a week to prepare for Making Tax Digital (MTD) for Value Added Tax (VAT) becoming mandatory for VAT-registered businesses on 1 April, HM Revenue and Customs (HMRC) said today.

Businesses have less than a week to prepare for Making Tax Digital (MTD) for Value Added Tax (VAT) becoming mandatory for VAT-registered businesses on 1 April, HM Revenue and Customs (HMRC) said today.

Self Assessment customers have just one week left to pay their tax bill or set up a payment plan to avoid incurring a penalty, HM Revenue and Customs (HMRC) has urged.

Customers have until 1 April to pay all tax due from their 2020/21 tax return and not receive a late payment penalty. If they are unable to pay in full, there is still time to set up an online payment plan to spread the cost of t

HM Revenue and Customs (HMRC) is warning Post Office card account holders, who receive HMRC-related payments, that time is running out – with just two weeks left to switch their accounts.

HM Revenue and Customs (HMRC) is warning Self Assessment customers to be on their guard following the Self Assessment deadline after more than 570,000 scams were reported to HMRC in the last year.

At this time of year, Self Assessment customers are at increased risk of falling victim to scams, even if they don’t mention Self Assessment. They can be taken in by scam texts, emails or calls either

Moving aid and donations to the people of Ukraine will be made easier thanks to a customs easement, the UK Government announced today.

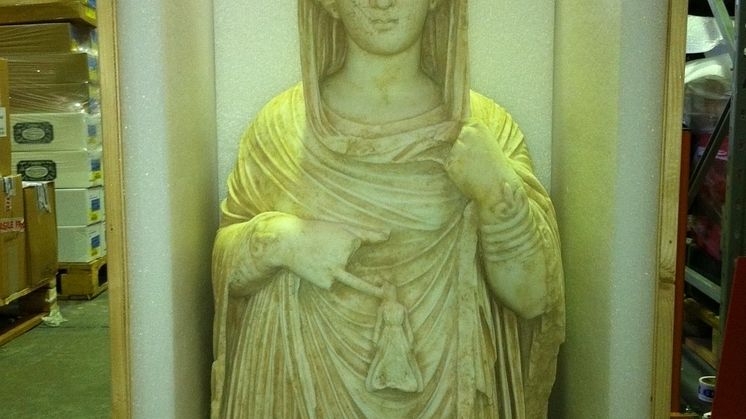

A 2,500-year-old statue that was smuggled into the UK and seized by HM Revenue and Customs (HMRC) has been returned to the Libyan Government.

HM Revenue and Customs (HMRC) is today warning customers not to share sensitive personal information online to avoid their identities being used to commit tax fraud.

HM Revenue and Customs (HMRC) is reminding about 7,500 tax credits, Child Benefit and Guardian’s Allowance customers they have just one month left to switch their Post Office card account.

HMRC will stop making payments to Post Office card accounts after 5 April 2022 so customers must notify HMRC of their new account details, so they don’t miss out on vital payments.

In November 2021, HMRC e

Tax agents and accountants will be able to send bulk appeals against late filing penalties for tax returns filed after 28 February due to COVID-19, HM Revenue and Customs (HMRC) has confirmed.

HM Revenue and Customs (HMRC) has revealed that more than one million customers filed their late tax returns in February – taking advantage of the extra time to complete their Self Assessment without facing a penalty.

About 12.2 million customers were expected to file a return for the 2020/21 tax year and more than 11.3 million customers submitted theirs by 28 February.

The deadline for subm

Time is running out for customers who still need to file their Self Assessment tax return and avoid a penalty, HM Revenue and Customs (HMRC) has warned.

Almost 100,000 Self Assessment customers have used online payment plans to spread the cost of their tax bill into manageable monthly instalments since April 2021, HM Revenue and Customs (HMRC) has revealed.