HMRC wins employment income avoidance case

A tax tribunal ruling against an income tax avoidance scheme is expected to protect up to £400 million in tax that would otherwise not have been paid.

A tax tribunal ruling against an income tax avoidance scheme is expected to protect up to £400 million in tax that would otherwise not have been paid.

More than 99 per cent of Pay As You Earn (PAYE) records are now successfully being reported in real time, HM Revenue and Customs (HMRC) announced today as it launched a package of support for micro businesses.

The winners of the HM Revenue and Customs (HMRC) External Engagement Awards 2013 have been announced.

HM Revenue and Customs (HMRC) has announced plans for paperless Self Assessment (SA) tax returns in a consultation document published today.

Care sector workers are in line for nearly £340,000 in back pay as a result of investigations by HM Revenue and Customs (HMRC).

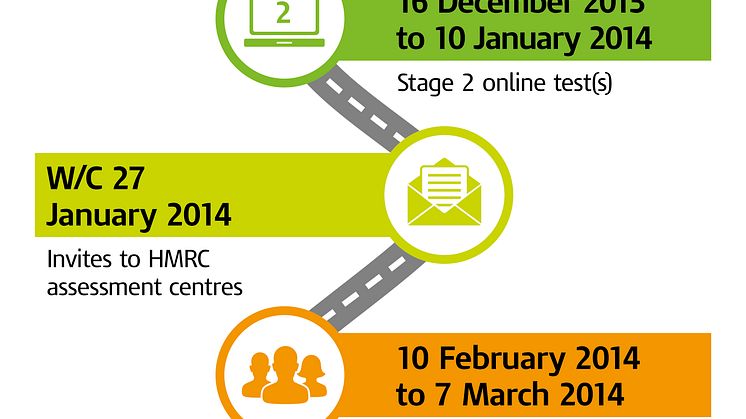

Graduates have a week left to apply to join HM Revenue and Customs (HMRC) as tax trainees next year.

Tax cheats in the North East who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

Tax cheats in the South East and South who hide their wealth are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

Tax cheats in the South East and South road transport industry are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

Gill Aitken has been appointed as HM Revenue and Customs’ (HMRC’s) General Counsel and Solicitor.

Around 206,000 businesses in London could see their National Insurance Contributions (NICs) cut by up to £2,000 when the new Employment Allowance is introduced in April 2014.

Business start-ups can take part in four free live tax webinars run by HM Revenue and Customs (HMRC) on 7 December as part of Small Business Saturday.

Christmas shoppers looking for bargains overseas have been warned not to get hit by unexpected charges, HM Revenue and Customs (HMRC) cautioned today.

If you haven’t yet sent in your 2012/13 tax return, remember to do it online to avoid a penalty.

An offshore tax avoidance scheme used by an FTSE 100-listed investment management company to pay its employees tax-free bonuses has been closed by Scotland’s most senior court.

Unused Pay As You Earn (PAYE) schemes will be shut down, HM Revenue and Customs (HMRC) announced today.

There are just days left to send your 2012/13 paper tax return to HM Revenue & Customs (HMRC), if you want to beat the 31 October deadline and avoid a penalty.

HM Revenue and Customs (HMRC) has today opened discussions with the commercial sector about how it could help to reduce tax credits error and fraud. This follows a short trial earlier this year with a private sector supplier.

Tax cheats in Scotland and Northern Ireland who try to fraudulently reclaim VAT are being targeted as part of an HM Revenue and Customs (HMRC) taskforce.

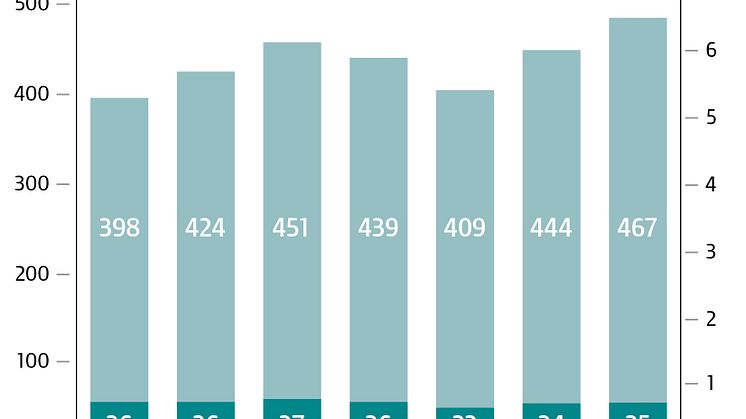

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2011-12 at 7 per cent (£35 billion) of tax due, continuing a long-term downward trend.