Company car drivers can report changes to HMRC online

An online trial has been launched by HM Revenue and Customs (HMRC), allowing company car drivers to make changes to car and fuel benefits that will affect their tax codes.

An online trial has been launched by HM Revenue and Customs (HMRC), allowing company car drivers to make changes to car and fuel benefits that will affect their tax codes.

More than eight million taxpayers who filed their 2013-14 tax return electronically by the 31 January deadline can now access their online tax summary.

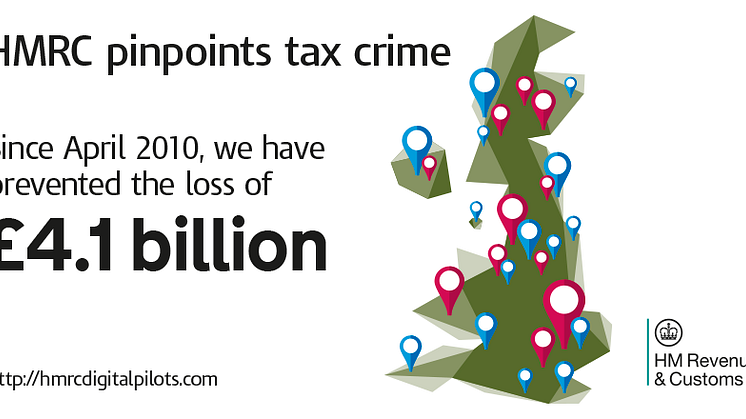

An online map pinpointing tax cheats around the country together with their crime and sentence has been launched today by HM Revenue and Customs (HMRC). The map allows people to see the impact of HMRC’s enforcement work.

HM Revenue and Customs (HMRC) welcomed the report by the National Audit Office published today, which recognised the progress the department has made over the past five years in increasing revenues, reducing costs and improving customer service.

HM Revenue and Customs (HMRC) oversaw the biggest digital Self Assessment event ever this year, receiving 10.24 million tax returns by midnight on 31 January – a record 85.5 per cent of which were sent online, it revealed today.

HM Revenue and Customs (HMRC) has today published the consultation paper, ‘Strengthening Sanctions for Tax Avoidance’, setting out proposals to tackle the serial use of tax avoidance schemes.

There are just 10 days left to send your 2013-14 tax return to HM Revenue and Customs (HMRC) and avoid a £100 late-filing penalty.

HM Revenue and Customs (HMRC) today began sending 650,000 email reminders to people who file their tax returns online, but have yet to complete this year’s Self Assessment tax return or pay what they owe before the 31 January deadline.

Women are more likely than men to send in their tax return on time, an HM Revenue and Customs (HMRC) analysis has revealed.

Ten of the most terrible excuses for missing the 31 January tax return deadline have been revealed today by HM Revenue and Customs (HMRC).

Digital services sold to private EU consumers will, from tomorrow (1 January 2015), be taxed where the customer lives, rather than where the business is based, HM Revenue and Customs (HMRC) has reminded UK businesses.

HM Revenue and Customs (HMRC) received 1,773 online tax returns on Christmas Day – a 13 per cent increase on last year’s total of 1,566.

More than half a million businesses have signed up to an online tax account – Your Tax Account – HM Revenue and Customs (HMRC) announced today.

A tax tribunal has upheld a legal ruling against a Stamp Duty Land Tax (SDLT) avoidance scheme, protecting up to £123 million in tax.

HM Revenue and Customs (HMRC) has secured almost all of the disputed tax due from the first group of tax avoidance scheme users to receive Accelerated Payment notices.

HM Revenue and Customs (HMRC) is urging first-time Self Assessment (SA) filers who haven’t sent in their returns to register for its online services now.

HM Revenue and Customs (HMRC) has published additional guidance [hyperlink] for UK micro and small businesses who supply digital services to consumers in other EU Member States.

HM Revenue and Customs (HMRC) has re-launched Supporting Small Business, which lays out how the department is making tax easier, quicker and simpler.

Solicitors are being given the chance by HM Revenue and Customs (HMRC) to bring their tax affairs up to date or face tougher penalties, as part of a new tax campaign.

From today, businesses that offer gambling to UK customers from overseas will have to pay Remote Gaming Duty (RGD), General Betting Duty (GBD) and Pool Betting Duty (PBD), HM Revenue and Customs (HMRC) has confirmed.