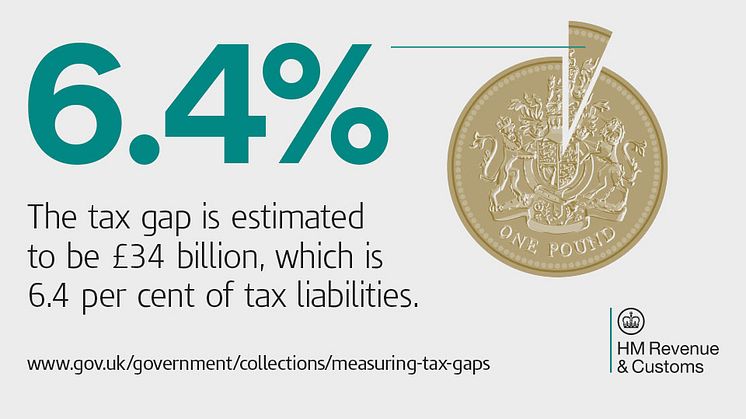

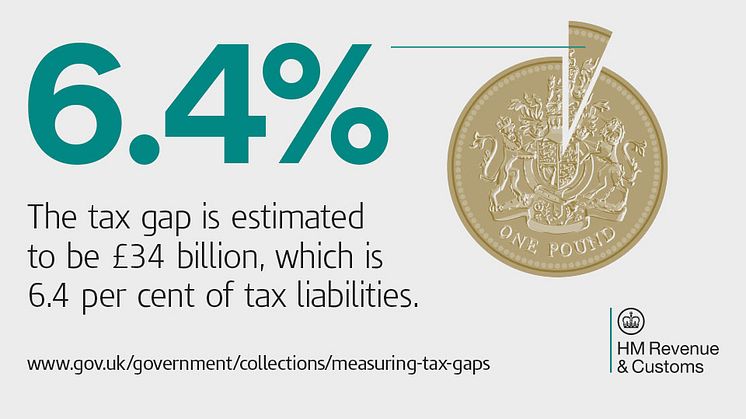

UK tax gap falls to 6.4 per cent

The tax gap for 2013-14 was 6.4 per cent of tax due, continuing a long-term downward trend, reflecting that HM Revenue and Customs’ (HMRC) approach is delivering steady and sustained progress.

The tax gap for 2013-14 was 6.4 per cent of tax due, continuing a long-term downward trend, reflecting that HM Revenue and Customs’ (HMRC) approach is delivering steady and sustained progress.

HM Revenue and Customs (HMRC) taskforces have brought in £109 million in the last six months it was revealed today. That includes £64.9 million recovered in the first three months of this year, more than double the figure for the same period in 2014.

A campaign aimed at helping residential landlords get their tax affairs in order has brought in more than £50 million, HM Revenue and Customs (HMRC) announced today.

A complex tax avoidance scheme used mainly by property developers and IT contractors has been defeated at Tribunal by HM Revenue and Customs (HMRC).

With 200 places available, HMRC is looking for the UK’s top graduates to join its graduate training scheme.

HM Revenue and Customs (HMRC) today announced that two taskforces taking on tax cheats in South Wales and South West England have collected over £20 million in just three years.

A taskforce set up by HM Revenue and Customs (HMRC) to check that taxi operators and drivers have paid the tax they owe, has targeted 8 business premises across Northern Ireland this morning as part of an investigation into suspected tax evasion.

A taskforce set up by HM Revenue and Customs (HMRC) to check that taxi operators and drivers have paid the tax they owe, has targeted 36 business premises across Scotland this morning as part of an investigation into suspected tax evasion.

HMRC has collected £1 billion in tax payments from users of tax avoidance schemes as a result of the government’s new rules to collect disputed tax upfront, the Financial Secretary to the Treasury, David Gauke, announced today.

HM Revenue and Customs published its Third-Party Tax Software and Application Programme Interface (API) strategy today.

More than 750,000 people renewed their tax credits online, almost doubling last year’s figure, HM Revenue and Customs (HMRC) revealed today.

An attempt to have Stamp Duty Land Tax (SDLT) anti-avoidance rules declared unlawful has been firmly rejected by the Court of Appeal.

HM Revenue and Customs (HMRC) today announced that it will bring some existing IT services under its direct control, while it continues to plan the transition to a new IT delivery model following the ending of the Aspire contract in 2017.

HMRC has won another major tax avoidance case against Abbey National Treasury Services PLC (ANTS), protecting more than £85 million for UK taxpayers.

A challenge in the High Court to the legality of Accelerated Payment Notices has been comprehensively rejected.

Employers in the hairdressing and beauty sectors who pay their staff below the national minimum wage (NMW) are being targeted in a new campaign announced today.

Treasury Minister Damian Hinds visited Belfast and Newry today as HM Revenue and Customs (HMRC) unveiled new roadside fuel testing equipment to tackle the trade in illicit diesel.

More than half a million people have renewed their tax credits online, 278,000 more than at the same time last year.

HM Revenue and Customs (HMRC) has defeated an artificial tax avoidance scheme involving the Brain Disorders Research Limited Partnership and Neil Hockin (a partner), after the First-Tier Tribunal ruled against the users’ attempts to claim £29 million in tax relief. The investors claimed to have spent £122 million on research, when in fact only £7 million reached the genuine research company.

Alcohol wholesalers need to start preparing to apply for the new Alcohol Wholesaler Registration Scheme, HM Revenue and Customs urged today.