Helping Hand to Set Up New Businesses

More than 200,000 new businesses have used a new one-stop cross-government service allowing new start-ups to register their company and also register for tax at the same time.

More than 200,000 new businesses have used a new one-stop cross-government service allowing new start-ups to register their company and also register for tax at the same time.

Around 5,542,000 taxpayers have less than a month to complete their Self Assessment tax returns before the 31 January deadline.

Smugglers, potential arms dealers and globe-trotting tax fugitives all feature in HM Revenue and Customs top ten criminal cases of 2018.

This year’s list once again demonstrates HMRC’s relentless pursuit of tax criminals and shows the lengths some individuals will go to steal money destined to support important public services.

The 2018 list demonstrates the sheer diversity of crimes HMRC d

Completing your tax return may not be top of your priorities on Christmas Day, but that didn’t stop 2,616 taxpayers from filing their Self Assessment returns on 25 December.

For some taxpayers completing their return on Christmas Day is as traditional as spending time with family and friends, or waiting for the Boxing Day sales to start. The peak time was between 1pm and 2pm, when more than 230

Millions of employees in the service industry could collect an early Christmas present from HM Revenue and Customs (HMRC).

Workers including nurses, hairdressers, construction workers and those in retail and food may be able to claim rebates.

Staff in these types of roles sometimes have to dip into their own pockets to pay for work-related expenses like car mileage, replacing or repairing sm

HM Revenue and Customs (HMRC) has written to two million customers in Wales ahead of the introduction of the new Welsh Rates of Income Tax (WRIT) in April next year.

More than 180,500 first time buyers have pocketed the cash they would have spent on Stamp Duty Land Tax (SDLT) for their new homes, statistics published by HM Revenue and Customs (HMRC) reveal.

Soft drinks manufacturers and traders have paid an extra £153.8 million in tax since April, statistics published by HM Revenue and Customs (HMRC) reveal today.

University students are being targeted by scammers with fake tax refunds in an effort to steal money and personal details, warns HM Revenue and Customs (HMRC).

From helping people buy their first home to government-funded top-ups for savers, HM Revenue and Customs (HMRC) is supporting Talk Money Week and reminding taxpayers how the department can help boost their finances.

Avoid the last-minute rush to complete your 2017/18 Self Assessment tax return by doing it early, urges HM Revenue and Customs (HMRC).

A pilot for a new online VAT service was launched today, with HM Revenue & Customs (HMRC) inviting more than half a million businesses to try it ahead of new rules coming into force in April 2019.

HM Revenue and Customs (HMRC) is reminding customers that time is running out to register for Self Assessment.

Hardworking people on low incomes are set to benefit from a new Government savings account that offers a 50% bonus. Help to Save will reward savers with an extra 50p for every £1 saved, meaning over 4 years a maximum saving of £2,400 would result in an overall bonus of £1,200.

HM Revenue and Customs (HMRC) is urging UK taxpayers to come forward and declare any foreign income or profits on offshore assets before 30 September to avoid higher tax penalties.

Former top football agent, Jerome Anderson, has lost his £1.2 million tax battle with HMRC.

Thousands of parents could be at risk of missing out on hundreds of pounds from their tax credits by accidently reporting their income incorrectly.

HM Revenue and Customs (HMRC) has today launched two new educational videos to help prepare teenagers for working life.

There’s just one week to go to the 31 July tax credit renewal deadline and HMRC is urging over a million customers yet to renew to do it online today because this is the quickest and easiest way.

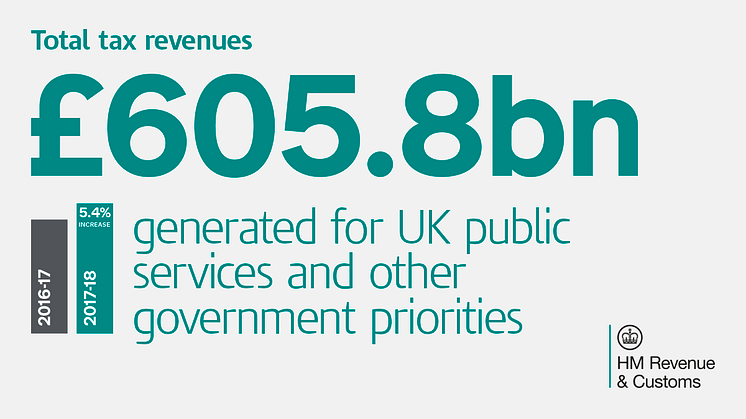

HMRC has published its Annual Report and Accounts for 2017 to 2018 today, 12 July.

The report and accompanying documents can be read here: https://www.gov.uk/government/publications/hmrc-annual-report-and-accounts-2017-to-2018

Jon Thompson, Chief Executive, outlines the achievements of the department in the last year and sets out the goals for the department in 2018 to 2019.