New digital tax system to give over 1 million businesses more financial control

From today, the government’s major Making Tax Digital programme becomes law for over one million VAT registered businesses earning over £85,000.

From today, the government’s major Making Tax Digital programme becomes law for over one million VAT registered businesses earning over £85,000.

HM Revenue and Customs (HMRC) has won a legal case over tax avoidance scheme promoter Hyrax Resourcing Ltd which will help the tax authority collect over £40 million in unpaid taxes.

The victory over Hyrax means the promoter now has to disclose the details of their tax avoidance scheme to HMRC, along with the names and addresses of 1,180 high earners who used it.

If Hyrax fail to provide the

There is just one week to go until Making Tax Digital for VAT is introduced for more than a million businesses.

The Financial Secretary to the Treasury, Mel Stride MP, has underscored his commitment for the UK to lead the fight against organised tax fraud and evasion in a visit to HMRC’s fraud investigation and intelligence teams on 14 March.

Households with a landline number should be vigilant of phone calls from fraudsters pretending to be the taxman, warns HM Revenue and Customs (HMRC).

Businesses are being urged to get ready as over 2,000 businesses a day sign up for Making Tax Digital for VAT

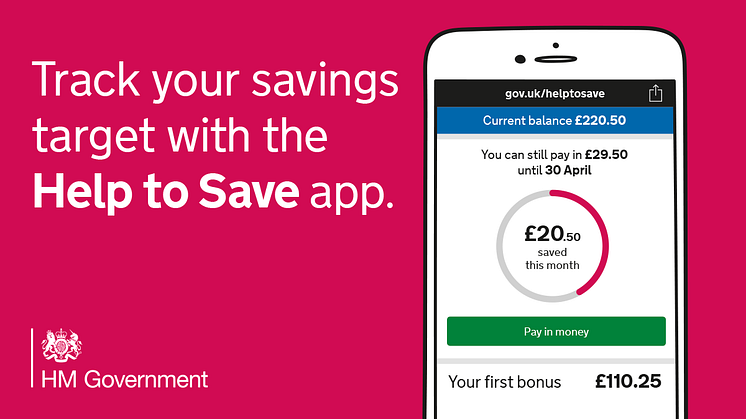

More than 90,000 people have signed up to the Government’s new saving account – Help to Save – depositing over £13 million.

HM Revenue and Customs (HMRC) is urging business owners to prepare now and consider three steps to ensure their businesses can continue to trade with the EU if the UK leaves the EU without a deal.

Senior Decision Makers in finance and accounting admit to not being the best at keeping receipts, as 65% confess to having lost them, according to a new YouGov poll out today.

HM Revenue and Customs (HMRC) is sharing the love this Valentine’s Day and encouraging married couples and those in a civil partnership to sign up for Marriage Allowance.

A total of 93.68% of Self Assessment tax returns – a new record – were completed by yesterday’s midnight deadline, reveals HM Revenue and Customs (HMRC).

More than 241,000 first time buyers have pocketed the cash they would have spent on Stamp Duty Land Tax (SDLT) for their new homes, statistics published by HM Revenue and Customs (HMRC) reveal.

More than 3.5 million customers have just one week left to complete their Self Assessment tax returns and pay any tax owed, warns HM Revenue and Customs (HMRC).

Start a new saving habit in 2019 and get a 50% boost - New app tool to help savers set goals and personal reminders

Most of our customers complete their tax returns honestly and on time but every year HM Revenue and Customs (HMRC) receives some outlandish excuses and expense claims.

Over 4,600 online sellers have been red-flagged to marketplaces for tax evasion during the last two years, reveals HM Revenue and Customs (HMRC). As a result, many sellers have had their online stores deleted.

Fans of The Apprentice will know that Swimwear designer Sian Gabbidon was chosen as the winner of The Apprentice 2018 by Lord Sugar earlier this month. The 26-year-old, from Leeds, beat nut milk entrepreneur Camilla Ainsworth, to win a £250,000 investment from Lord Sugar in her swimwear company.

More than 200,000 new businesses have used a new one-stop cross-government service allowing new start-ups to register their company and also register for tax at the same time.

Around 5,542,000 taxpayers have less than a month to complete their Self Assessment tax returns before the 31 January deadline.

Smugglers, potential arms dealers and globe-trotting tax fugitives all feature in HM Revenue and Customs top ten criminal cases of 2018.

This year’s list once again demonstrates HMRC’s relentless pursuit of tax criminals and shows the lengths some individuals will go to steal money destined to support important public services.

The 2018 list demonstrates the sheer diversity of crimes HMRC d