Blog post -

EU VAT changes: top tips

by Andrew Webb, Senior VAT Policy Manager, HMRC

VAT place of supply of services rule changes from 1 January 2015.

HM Revenue and Customs’ top tips for businesses preparing for the changes:

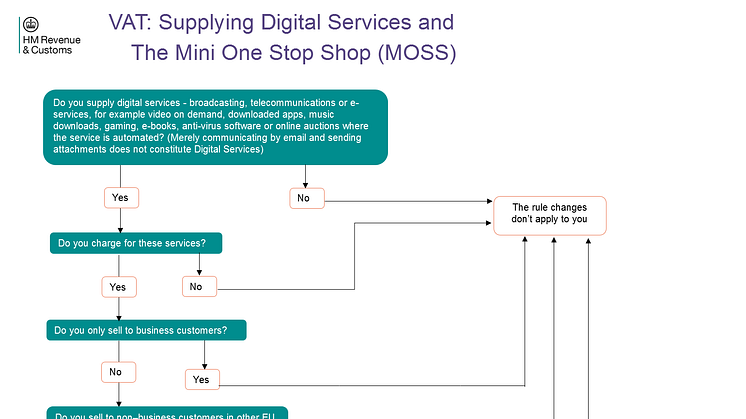

- Check to ensure that you are supplying digital services (for example, software, games, online journals) that fall within the scope of the new VAT provisions, rather than services in which the internet is used as a publicity or communication medium (for example, tickets to entertainment events, hotel accommodation or car hire);

- Check to establish whether your customers are 'taxable persons' who are in business and have provided you with their VAT Registration Number (VRN), or other information that they are in business. If they are, you will be making business to business (B2B) rather than business to consumer (B2C) supplies, and these will be dealt with under existing EU VAT rules;

- If your business is supplying digital services, establish whether you are supplying them through a digital platform, store or marketplace because, if that is the case, the business that operates and manages the platform will be responsible for accounting to the authorities for the VAT on the B2C supply, and you will only be making a business to business (B2B) supply;

- If you are making B2C digital service supplies to customers in other EU Member States, and you are looking to develop your business, there are clear and significant benefits in considering registering for the VAT Mini-One Stop Shop (MOSS), rather than registering for VAT in each Member State, even if to do so you have to register voluntarily for VAT in the United Kingdom;

- If you are not currently VAT registered, provided you separate the cross-border digital services business from the UK business, you can voluntarily register the cross-border business for VAT and then for MOSS;

- If you do decide to register for MOSS to account for the VAT on all your EU cross-border supplies, use the European Commission's EU VAT Web Portal to determine the VAT information (for example, VAT Rates, VAT Invoicing requirements) in each Member State where you have customers so you can quickly and easily complete your calendar quarterly MOSS VAT Return;