Document -

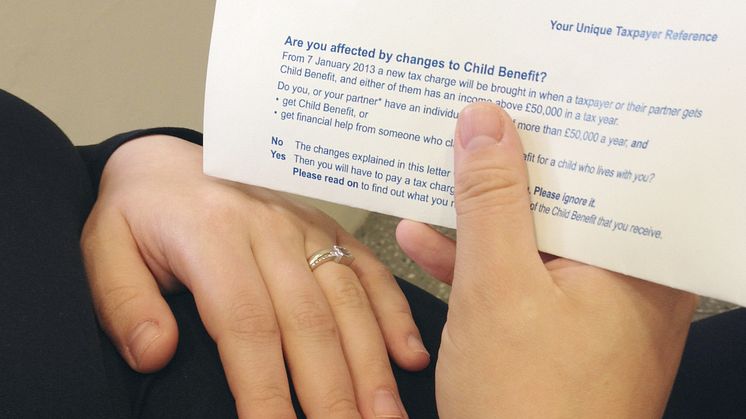

HMRC Briefing - High Income Child Benefit Charge

This briefing explains who will be affected, how the charge will work and how we will administer it, including the information we will provide to customers affected by the changes.

go to media item

- License:

- Creative Commons Attribution, no derivatives

With a Creative Commons license, you keep your copyright but allow people to copy and distribute your work provided they give you credit. You permit others to copy, distribute and transmit only unaltered copies of the work — not derivative works based on it.

- File format: