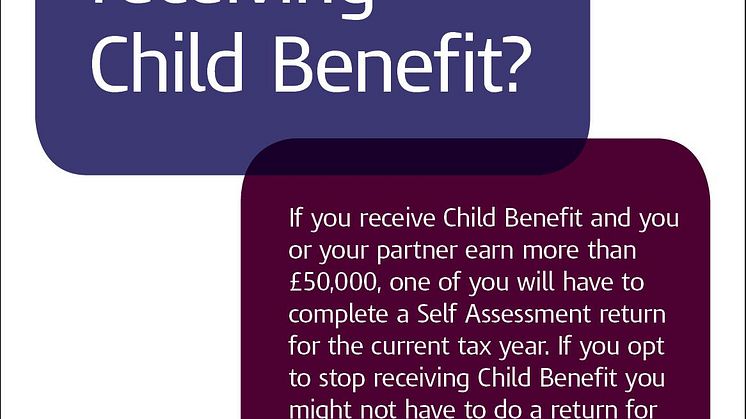

Child Benefit reminder for higher income earners

HM Revenue and Customs (HMRC) is today reminding people with an income over £60,000 whose family is still receiving Child Benefit to opt out before 28 March if they wish to avoid filling in a tax return and repaying the benefit for the 2013/14 tax year.