Know your overseas shopping limits this Christmas

Christmas shoppers looking for bargains overseas have been warned by HM Revenue and Customs (HMRC) not to get hit by unexpected charges.

Christmas shoppers looking for bargains overseas have been warned by HM Revenue and Customs (HMRC) not to get hit by unexpected charges.

The inaugural meeting of HM Revenue and Customs’ (HMRC) new stakeholder group, the Employment and Payroll Group (EPG), will be held on 4 December, it was announced today.

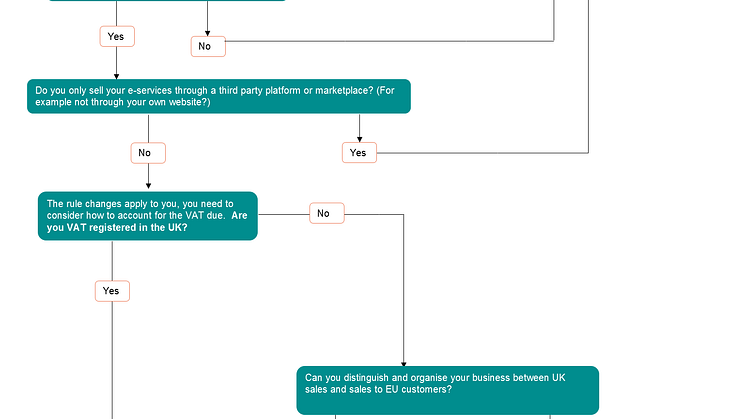

VAT place of supply of services rule changes from 1 January 2015. Here are HM Revenue and Customs’ top tips for businesses preparing for the changes:

Plans to recover tax and tax credit debts directly from the bank accounts of people and businesses who refuse to pay what they owe will include strong safeguards to protect vulnerable taxpayers, the government announced today.

HM Revenue and Customs (HMRC) has clocked up another three major legal victories over corporate tax avoidance schemes, protecting over £100 million of tax.

A Fermanagh farmer, who was jailed for stealing nearly £500,000 in fraudulent VAT repayments, has been ordered to repay £60,000 or serve a further two years in prison.

HM Revenue and Customs (HMRC) today issued a list of ‘10 things a tax avoidance scheme promoter won’t always tell you’.

The largest ever toxic waste dump linked to diesel laundering in the UK has been uncovered at a farm in Co Armagh this morning by HM Revenue and Customs (HMRC).

If you haven’t yet sent your 2013/14 tax return to HM Revenue and Customs (HMRC), remember not to do it on paper – or you’ll end up with a £100 late-filing penalty.

A Co Armagh man has been arrested in connection with a suspected multi million pound VAT fraud, linked to the transport industry, after an investigation by HM Revenue and Customs (HMRC).

HM Revenue and Customs has sent notices to tax avoidance scheme users to pay over £250 million of disputed tax under the Accelerated Payments regime introduced in this year’s Finance Act.

HM Revenue and Customs (HMRC) is warning taxpayers to be on their guard against fraudulent phishing emails, after almost 75,000 fake emails were reported to the taxman over the last six months.