Businesses sign up to online tax account

More than half a million businesses have signed up to an online tax account – Your Tax Account – HM Revenue and Customs (HMRC) announced today.

More than half a million businesses have signed up to an online tax account – Your Tax Account – HM Revenue and Customs (HMRC) announced today.

A tax tribunal has upheld a legal ruling against a Stamp Duty Land Tax (SDLT) avoidance scheme, protecting up to £123 million in tax.

HM Revenue and Customs (HMRC) has secured almost all of the disputed tax due from the first group of tax avoidance scheme users to receive Accelerated Payment notices.

HM Revenue and Customs (HMRC) is urging first-time Self Assessment (SA) filers who haven’t sent in their returns to register for its online services now.

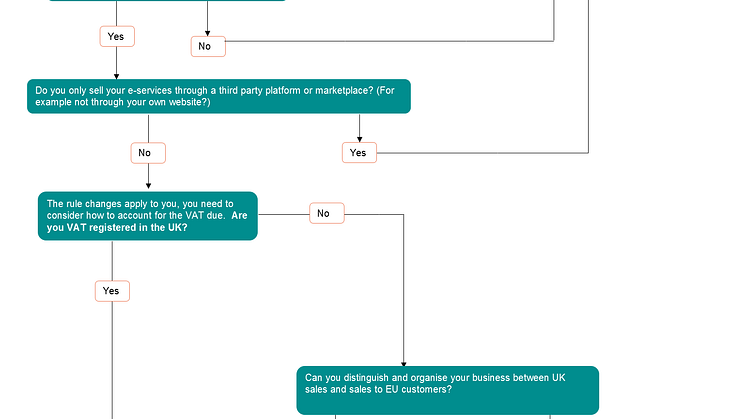

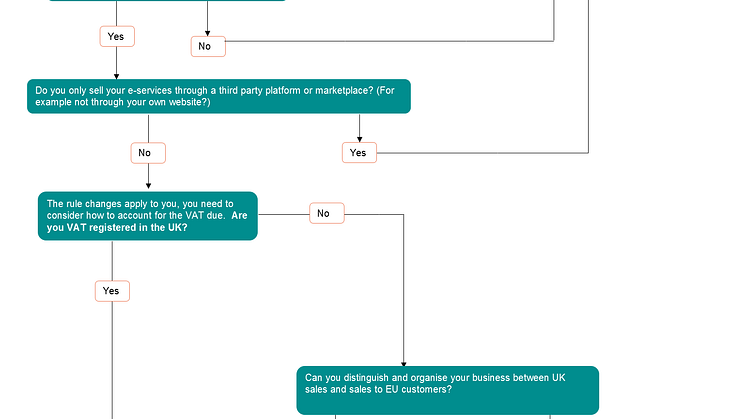

HM Revenue and Customs (HMRC) has published additional guidance [hyperlink] for UK micro and small businesses who supply digital services to consumers in other EU Member States.

HM Revenue and Customs (HMRC) has re-launched Supporting Small Business, which lays out how the department is making tax easier, quicker and simpler.

Solicitors are being given the chance by HM Revenue and Customs (HMRC) to bring their tax affairs up to date or face tougher penalties, as part of a new tax campaign.

From today, businesses that offer gambling to UK customers from overseas will have to pay Remote Gaming Duty (RGD), General Betting Duty (GBD) and Pool Betting Duty (PBD), HM Revenue and Customs (HMRC) has confirmed.

VAT place of supply of services rules changes from 1 January 2015. HM Revenue and Customs (HMRC) held a Twitter Q & A on 27 November 2014. Here we list some of the main questions to come out of that.

Christmas shoppers looking for bargains overseas have been warned by HM Revenue and Customs (HMRC) not to get hit by unexpected charges.

The inaugural meeting of HM Revenue and Customs’ (HMRC) new stakeholder group, the Employment and Payroll Group (EPG), will be held on 4 December, it was announced today.

VAT place of supply of services rule changes from 1 January 2015. Here are HM Revenue and Customs’ top tips for businesses preparing for the changes: