HMRC writes to Scottish Rate of Income Tax payers

HM Revenue and Customs will start sending letters this week to potential Scottish taxpayers as part of the next stage of preparations for the introduction of the Scottish Rate of Income Tax.

HM Revenue and Customs will start sending letters this week to potential Scottish taxpayers as part of the next stage of preparations for the introduction of the Scottish Rate of Income Tax.

The Financial Secretary to the Treasury, David Gauke, today launched a campaign warning offshore tax evaders that HMRC will start to receive details on UK taxpayers from more than 90 countries, under new global agreements championed by the UK.

HMRC has today announced the next step in its ten-year modernisation programme to create a tax authority fit for the future, committing to high-quality jobs and the creation of 13 new regional centres over the next five years, serving every nation and region in the UK.

In a major boost for pioneering small businesses, the Financial Secretary to the Treasury, David Gauke, today launched a new plan outlining how government will make it easier for small businesses investing in research and development to claim tax relief.

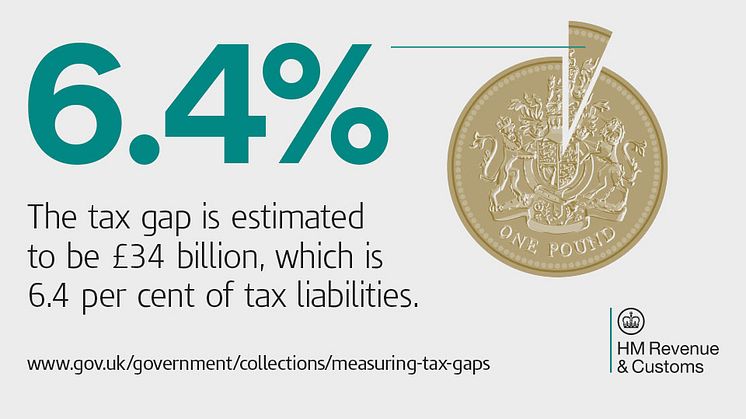

The tax gap for 2013-14 was 6.4 per cent of tax due, continuing a long-term downward trend, reflecting that HM Revenue and Customs’ (HMRC) approach is delivering steady and sustained progress.

HM Revenue and Customs (HMRC) taskforces have brought in £109 million in the last six months it was revealed today. That includes £64.9 million recovered in the first three months of this year, more than double the figure for the same period in 2014.

A campaign aimed at helping residential landlords get their tax affairs in order has brought in more than £50 million, HM Revenue and Customs (HMRC) announced today.

A complex tax avoidance scheme used mainly by property developers and IT contractors has been defeated at Tribunal by HM Revenue and Customs (HMRC).

With 200 places available, HMRC is looking for the UK’s top graduates to join its graduate training scheme.

HM Revenue and Customs (HMRC) today announced that two taskforces taking on tax cheats in South Wales and South West England have collected over £20 million in just three years.

A taskforce set up by HM Revenue and Customs (HMRC) to check that taxi operators and drivers have paid the tax they owe, has targeted 8 business premises across Northern Ireland this morning as part of an investigation into suspected tax evasion.

A taskforce set up by HM Revenue and Customs (HMRC) to check that taxi operators and drivers have paid the tax they owe, has targeted 36 business premises across Scotland this morning as part of an investigation into suspected tax evasion.