Almost 250,000 early birds file Self Assessment in first week

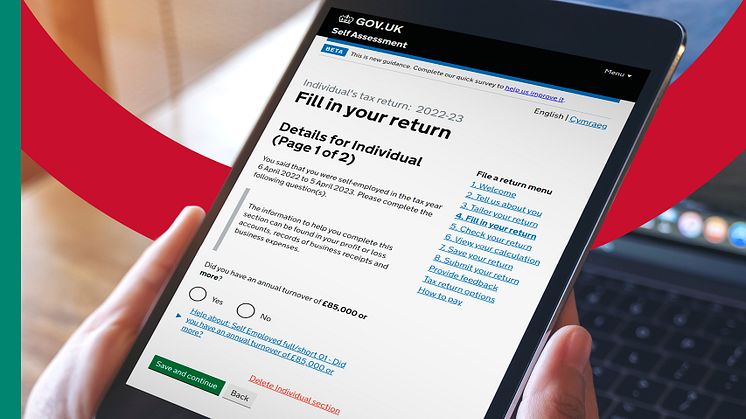

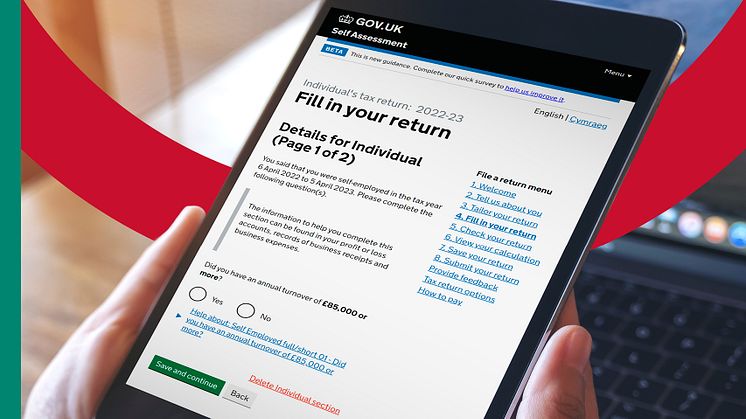

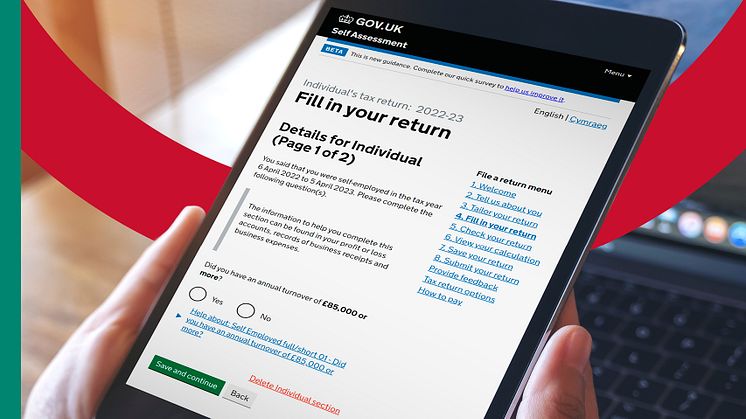

Almost 250,000 Self Assessment customers filed their 2022 to 2023 tax return during the first week of the tax year, HM Revenue and Customs (HMRC) has revealed.

Almost 250,000 Self Assessment customers filed their 2022 to 2023 tax return during the first week of the tax year, HM Revenue and Customs (HMRC) has revealed.

Two VAT fraudsters, who chose to spend an extra decade in prison rather than pay back stolen cash, have had their £2.1m Buckinghamshire country house sold by HM Revenue and Customs (HMRC).

Syed Ahmed and Shakeel Ahmad, both 51, were jailed for seven years in 2007 for their part in a £12.6m VAT fraud that saw 21 individuals receive prison sentences totalling 74 years.

The defendants were joi

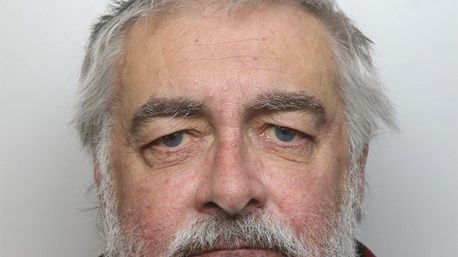

A tax agent who abused his position to steal from a dying man has been jailed for 3 years for 9 months. Joseph Logue, from Northampton, made Self Assessment repayment claims for his clients but kept the money for himself.

HM Revenue and Customs (HMRC) is reminding anyone who is new to Self Assessment for the 2022 to 2023 tax year that they have just 2 weeks until 5 October to tell HMRC and register.

Almost 430,000 18-21 year olds with an unclaimed Child Trust Fund, worth an average of £2,000, are being urged by HM Revenue and Customs (HMRC) to claim their cash as part of UK Savings Week (18 to 24 September 2023).

Child Trust Funds are long-term, tax-free savings accounts and were set up for every child born between 1 September 2002 and 2 January 2011, with the government contributing an i

With the new school term starting, HM Revenue and Customs (HMRC) is reminding families to open a Tax-Free Childcare account today to save up to £2,000 per child on their yearly childcare bills.

Families can use their Tax-Free Childcare account to pay for any approved childcare including holiday clubs, breakfast and after school clubs, child minders and nurseries.

The scheme provides wor

Parents have one week after GCSE results day to tell HM Revenue and Customs (HMRC) that their 16-year-old is continuing their education or training, to continue receiving Child Benefit.

Teenagers will find out their GCSE results this week and many will be considering their future and whether to stay on in education. Child Benefit payments stop on 31 August after a child turns 16, but parents ca

If someone has had a change in circumstances, then they might need to complete their first ever Self Assessment tax return for the 2022 to 2023 tax year, HM Revenue and Customs (HMRC) is reminding people.

Self Assessment customers could take advantage of four key benefits when filing their tax return early, HM Revenue and Customs (HMRC) has revealed.

More than 171,350 tax credits customers have until 31 July to renew their annual claim and HM Revenue and Customs (HMRC) is urging them to not miss out.

More than 27 million illicit cigarettes and 7,500kg of hand-rolling tobacco were seized under Operation CeCe in its first two years, HM Revenue and Customs (HMRC) and National Trading Standards have revealed.

HM Revenue and Customs (HMRC) is awarding £5.5 million to organisations within the voluntary and community sector to support customers who may need extra help with their tax affairs.