Press release -

Do you need to complete a Self Assessment tax return this year?

If someone has had a change in circumstances, then they might need to complete their first ever Self Assessment tax return for the 2022 to 2023 tax year, HM Revenue and Customs (HMRC) is reminding people.

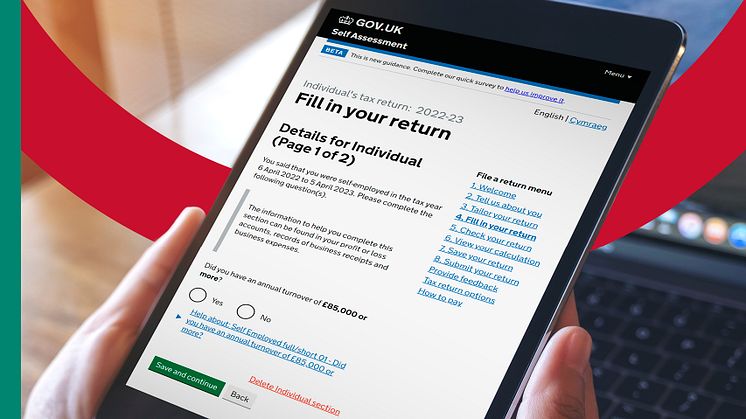

Taxpayers can use the quick and easy free online checking tool on GOV.UK and register with HMRC by 5 October if they do need to self-assess. Taxpayers can also use it if they think they may not need to complete one this year too.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“It is important that taxpayers check if they need to complete a Self Assessment tax return so they can pay the right amount of tax owed and avoid penalties for not filing a return. It is quick and easy to check by using the interactive tool on GOV.UK - there is no need to ring us.”

Taxpayers may need to complete a tax return if they:

- are newly self-employed and have earned more than £1,000

- have multiple sources of income

- have received any untaxed income, for example earning money for creating online content

- earn more than £100,000 a year

- earn income from property that they own and rent out

- are a new partner in a business partnership

- are claiming Child Benefit and they or their partner have an income above £50,000

- receive interest from banks and building societies (more than £10,000)

- receive dividends in excess of £10,000

- need to pay Capital Gains Tax

- are self-employed and earn less than £1,000 but wish to pay Class 2 NICs voluntarily to protect their entitlement to State Pension and certain benefits

The online checking tool can also be used by those who may no longer need to do Self Assessment, including if they:

- gave up work or retired

- are no longer self-employed

- earn below the minimum income thresholds

If taxpayers no longer think they need to complete a Self Assessment tax return for the 2022 to 2023 tax year, they should tell HMRC before the deadline on 31 January 2024 to avoid any penalties.

Taxpayers can register for Self Assessment on GOV.UK. Once registered, they will receive their Unique Taxpayer Reference, which they will need when completing their tax return.

HMRC has wide range of resources to help taxpayers file a tax return including a series of video tutorials on YouTube and a new step by step guide. for anyone that is filing for the first time.

Taxpayers need to be aware of the risk of falling victim to scams and should never share their HMRC login details with anyone, including a tax agent, if they have one. HMRC scams advice is available on GOV.UK.

Notes to Editors

- Taxpayers can register for Self Assessment on GOV.UK.

- Taxpayers can request to remove themselves from Self Assessment on GOV.UK.

- Taxpayers do not need to wait until 31 January before filing their tax return, help and support is available on GOV.UK to help them complete their return. They can submit it at any time but do not have to pay until the deadline, unless they choose to.

- Filing earlier also allows them to find out what they owe sooner and work out their budget.

- Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

- Check if you need to send a Self Assessment tax return

- Self Assessment tax returns

- Register for Self Assessment

- Starting Self Assessment

- About this guidance

- HMRC phishing and scams: detailed information

- Stop being self-employed

- File your tax return early

- HMRC email updates, videos and webinars for Self Assessment

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.