News -

Walking the halls of history with History Alice: PAYE at 80

Earlier this year, HM Revenue and Customs (HMRC) invited Alice Loxton, more familiarly known on social media as History Alice, to the HMRC office in central London to view some important documents marking their 80thbirthday.

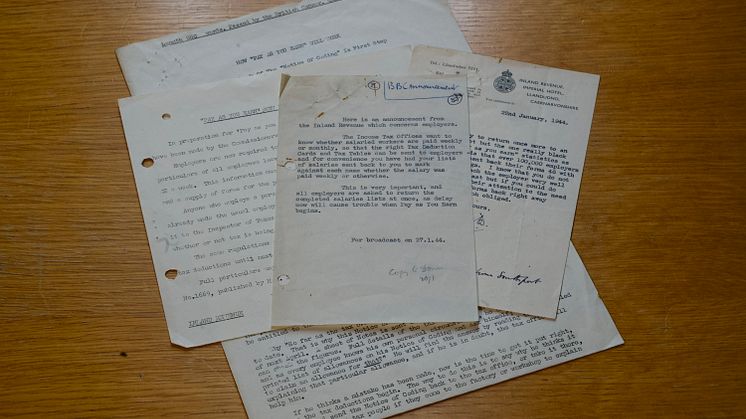

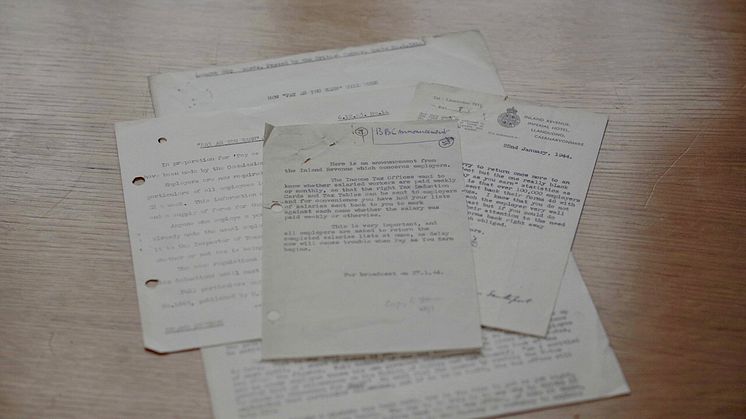

The historic documents are original paperwork relating to the introduction of Pay As You Earn (PAYE). On 6 April 1944, PAYE was introduced to streamline the tax collection process from employee earnings. Many women had stepped into roles left by men who had gone off to serve in the Second World War and the sudden growth in the workforce meant the number of people paying tax increased.

Replacing annual or twice-yearly tax collections, PAYE would be deducted by employers from either weekly or monthly wages. The increased frequency of tax being paid and recorded also meant an employee leaving work would begiven a P45 recording his or her tax code number, pay to date and tax paid to date to pass on to a new employer.

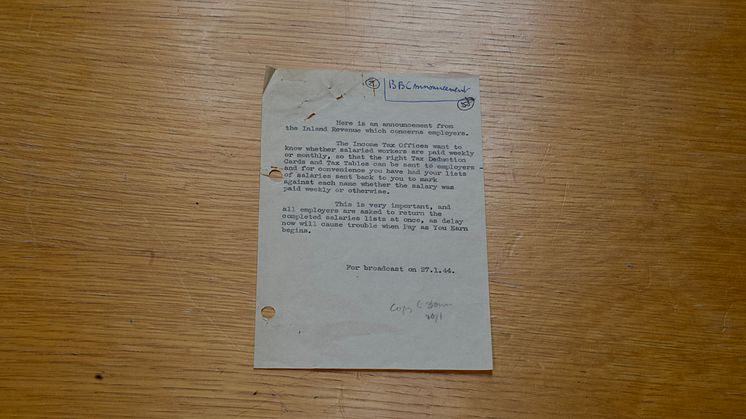

Ahead of the new tax legislation coming into effect, HMRC – or the Inland Revenue as it was in 1944 – had to code employees so the correct tax was deducted from their salary. Hidden among the documents that Alice saw was a memo to the BBC for broadcast, which called on employers to send salaries and payroll information to the Inland Revenue as any delay “will cause trouble when Pay As You Earn begins”.

By the end of January 1944, 15 million people, those earning more than £100 a year, had received notices telling them their tax code number.

Today, more than 30.5 million people pay Income Tax and National Insurance through PAYE, and employers share payroll information with HMRC in real-time.

Alice Loxton said:

“In post-war Britain, PAYE became a crucial bit of infrastructure, laying the foundations for building the nation’s economy. And it is testament to the success of this piece of legislation that today in 2024, it is still an integral part of the tax system, 80 years later.”

Taxpayers can also access their own tax information via the HMRC app, a tool that was inconceivable 80 years ago! You can use the app to find and save your National Insurance number, check your tax code and income, or use the tax calculator to work out your take home pay after Income Tax and National Insurance deductions. Download and get on the HMRC app today.

Watch the video with History Alice on Instagram.