Press release -

2010/11 tax gap figures published

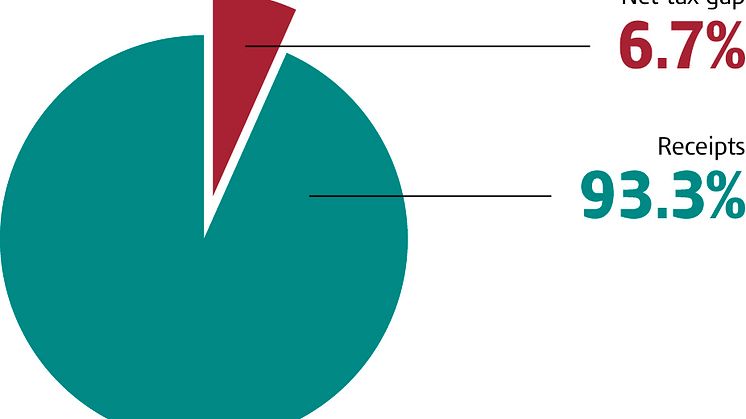

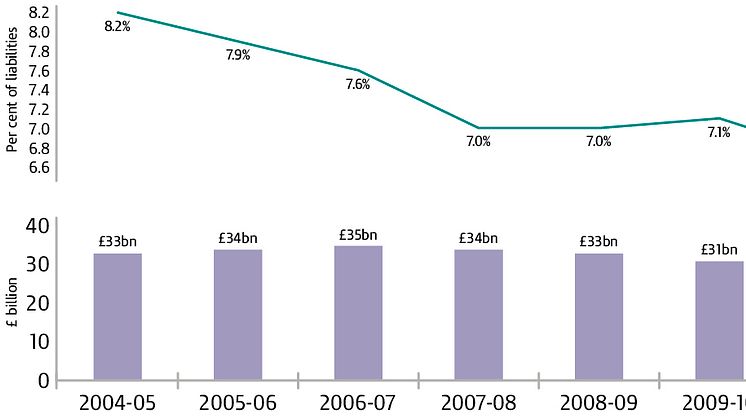

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2010/11 at £32 billion, or 6.7 per cent of tax due, compared to 7.1 per cent in 2009/10.

The tax gap is compiled from 30 separate estimates for different taxes. It is also broken down into the reasons that tax hasn’t been collected. These include tax evasion and avoidance, as well as customer error, the hidden economy, criminal attacks and where tax cannot be collected because businesses have become insolvent.

HMRC’s tax gap estimates go back as far as 2004/5. These are regularly revised to take account of improved methods and the latest available information, some of which has long lags as it takes time to settle tax enquiries. The figures published today include revisions going back to 2004/5, including downward revisions by the Office for National Statistics that affect the VAT gap. They show that the tax gap as a percentage of liabilities has declined from 8.2 per cent in 2004/5 to 6.7 per cent in 2010/11.

Exchequer Secretary David Gauke MP said:

“These tax gap figures show that the vast majority of people and businesses pay the tax they owe on time. Last year £468.9 billion was collected, including £13.9 billion brought in through HMRC’s work policing the rules.

“Every pound of tax that is not collected puts a greater burden on honest taxpayers and public services, so the Government and HMRC will continue to work together to make it harder for individuals and businesses not to pay the taxes that are due.

“We are determined to reduce the tax gap and have made £917 million available to help HMRC tackle avoidance and evasion.”

Lin Homer, HMRC’s Chief Executive, said:

“Our determination to support the honest majority and to crack down on evasion, avoidance and fraud have kept downward pressure on the tax gap. We are determined to do more and we are devoting increasing resources to pursuing those who do not pay the tax they owe, while making it easier for people and business to comply with their tax obligations.”

Notes to editors:

1. The UK is one of the few countries to publish its estimate of the tax gap; our transparency on this is a sign of our determination to tackle non-compliance. Caution must be exercised when comparing internationally, as methodologies, the periods that estimates relate to and tax systems differ. However, the figures indicate that the UK compares favourably internationally.

Country Tax gap as a % of total tax due

Mexico 23%

USA 14%

Sweden 10%

UK 6.7%

2. Attachments – publishable jpegs of two graphics ( graph showing tax gap figures since 2004-5 and pie chart showing net taxgap percentage )

3. A PDF version of the new publication is available here

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.