Press release -

‘Check your pay’ call to people in Christmas jobs

Festive workers who may be missing out on the National Minimum Wage or National Living Wage are being urged to check their pay.

Seasonal staff and students on short-term contracts over the Christmas period, including those working in shops, hotels, Christmas markets, garden centres, restaurants and warehouses, are legally entitled to the same minimum rates as other workers.

HM Revenue and Customs (HMRC) is reminding all workers to check their hourly rate of pay - in particular, looking out for any unpaid working time, such as time spent opening and closing a shop, training, picking up extra shifts and working longer hours. Deductions, for things like uniforms or tools, can also reduce pay rates.

In 2022-23, HMRC identified wage arrears of £13.7 million due to more than 108,000 underpaid UK workers.

Marc Gill, Director Individuals and Small Business Compliance, HMRC, said:

“We want to make sure that all workers, including seasonal staff and students, are being paid what they are due this festive period, which is why we are reminding everyone to check their pay.

“People should check their hourly rate and look out for any deductions or unpaid working time. It could take them below the minimum wage.

“HMRC looks into every minimum wage complaint, so if you think you are being short-changed you should get in touch. Don’t lose out - report it.”

The National Minimum Wage hourly rates are currently:

- £10.42 - Age 23 and over (National Living Wage)

- £10.18 - Age 21 to 22

- £7.49 - Age 18 to 20

- £5.28 - Age under 18

- £5.28 - Apprentice

Anyone not being paid what they are entitled to, or people concerned that someone they know may not be getting paid correctly, can report it online at https://www.gov.uk/minimum-wage-complaint. It is an easy process that takes around ten minutes and reports can be made after the employment has ended.

To speak with someone, raise a concern or get further information, people can also phone the Acas Pay and Work Rights helpline on 0300 123 1100 for confidential, free advice (Monday to Friday, 8am to 6pm). In Northern Ireland contact the Labour Relations Agency.

Employers can access support at any time to ensure they are paying their workers correctly:

- view the online employers’ guide on calculating the minimum wage

- watch our recorded webinars by clicking this link: National Minimum Wage videos and webinars

They can also contact the Acas helpline for advice.

Notes for Editors

1. For further information about the National Minimum Wage visit GOV.UK at:

- https://checkyourpay.campaign.gov.uk/

- https://www.gov.uk/guidance/calculating-the-minimum-wage

- https://www.gov.uk/national-minimum-wage/who-gets-the-minimum-wage

And the Acas website at: www.acas.org.uk/pay-and-wages.

2. HM Revenue and Customs (HMRC) is responsible for the enforcement of National Minimum Wage legislation. The Department for Business and Trade is responsible for National Minimum Wage (NMW) and National Living Wage (NLW) policy.

3. By law workers must be paid at least the minimum wage for their age for all of their time spent working.

4. The two most common causes of minimum wage underpayment are deductions and unpaid working time. Examples include:

- Expenses for tools or equipment needed for the job

- Cost of uniform or clothing connected with the job

- Unpaid travelling time between work locations

- Unpaid training time.

5. Employers who break minimum wage rules can face penalties of up to 200% of the underpayments owed to workers, and must pay the outstanding arrears due to workers on top of the penalty.

6. Employers who do not pay the NMW can be publicly named. The most recent list was published by the Department for Business and Trade on 21 June 2023. Those who fail to comply can face criminal prosecution, but most employers pay up when they realise mistakes have been made.

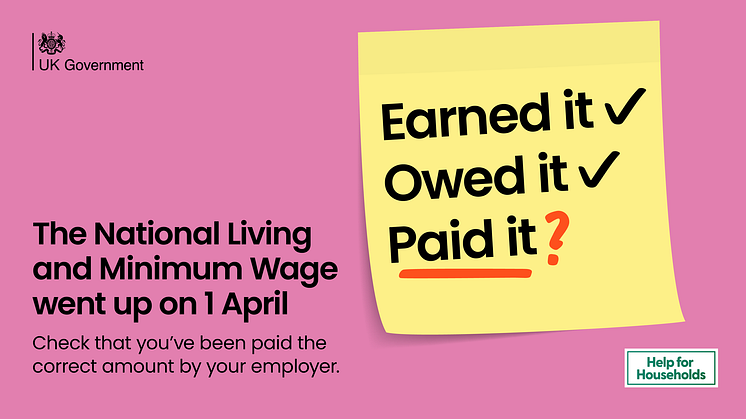

7. In November 2023 the UK Government announced the National Minimum Wage rates from 1 April 2024 will be:

- £11.44 - Age 21* and over (National Living Wage)

- £8.60 - Age 18 to 20

- £6.40 - Age under 18

- £6.40 – Apprentice

This includes reducing the National Living Wage threshold from ‘age 23 and over’ to ‘age 21* and over’ meaning more people will be entitled to receive the higher rate. The Department for Business and Trade estimates that 2.7 million workers will directly benefit from the 2024 National Living Wage increase.

8. Workers and employers in Northern Ireland can also contact the Labour Relations Agency helpline on 03300 555 300 (Monday to Friday, 9am to 5pm) or their website: www.lra.org.uk.

9. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

- Complain about pay and work rights

- Calculating the minimum wage

- National Minimum Wage videos and webinars

- The National Living Wage and National Minimum Wage

- The National Minimum Wage and Living Wage

- Acas -Pay and wages

- HM Revenue and Customs

- Department for Business & Trade

- Press release - More than 200 companies named for not paying staff minimum wage

- Press release - Record wage boost for nearly 3 million workers next year

- Labour Relations Agency - Northern Ireland

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.