Press release -

Child Benefit change: one month to go

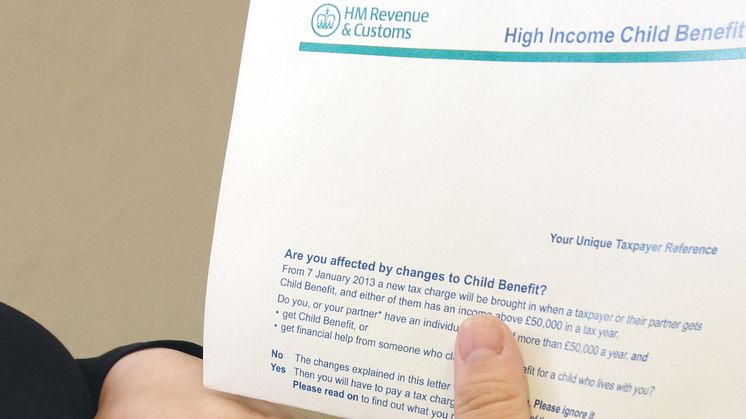

High-earning child benefit recipients have a month to decide whether to stop receiving the benefit or to pay a charge on it through Self Assessment.

The High Income Child Benefit Charge (HICBC) starts on 7 January, and will affect taxpayers with income of more than £50,000.

Lin Homer, HMRC’s Chief Executive, said:

“Over 680,000 people have already looked at information on HMRC’s website that explains the changes and what steps those affected can take. It is really easy to use and will help families come to a decision.”

The new charge will apply when a taxpayer or their partner’s income is more than £50,000 in a tax year, and if they or their partner receives Child Benefit.

For those with income of more than £60,000, the tax charge is 100 per cent of the amount of Child Benefit. If income is between £50,000 and £60,000, the charge is gradually increased to 100 per cent of the Child Benefit.

Those affected will need to decide whether to keep receiving Child Benefit and pay the tax charge through Self Assessment, or to stop receiving Child Benefit and not pay the new charge. If their income is between £50,000 and £60,000, the tax charge will always be less than the amount of Child Benefit, so they could lose money to which they are entitled if they opt to stop receiving Child Benefit. If Child Benefit recipients want to stop receiving the benefit, they should contact HMRC before 7 January.

For more information go to http://www.hmrc.gov.uk/childbenefitcharge

HMRC will hold a live twitter Q&A on HICBC on 3 January between 10.30am and 11.30am #hicbcqa

Notes to Editors

1. The High Income Child Benefit Charge applies to the partner with the higher income over £50,000. HMRC issued letters in November explaining the new High Income Child Benefit Charge to those families who they believe have a higher earner in the household and are currently claiming child benefit.

2. Only the Child Benefit recipient can stop Child Benefit payments. The Child Benefit recipient is, in most cases, the mother of the child(ren). Those receiving letters may not be the claimant and should discuss stopping payment with the claimant.

3. Follow HMRC on Twitter @HMRCgovuk

4. Images are available on HMRC’s flickr site www.flickr.com/hmrcgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.