Press release -

Countdown to tax return deadline

The countdown has begun to the 31 January Self Assessment deadline, with just days left for anyone with an outstanding 2011-12 tax return to send it online to HM Revenue and Customs (HMRC).

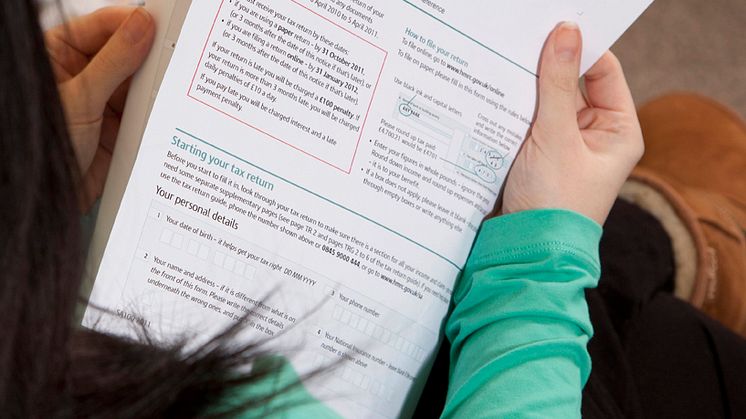

If you send your return late, you’ll receive a £100 penalty – even if you have no tax to pay or you pay your tax on time. The longer you delay, the more you’ll have to pay, as further late-filing penalties kick in after three, six and 12 months.

If you haven't sent a tax return online before, you’ll need to sign up for HMRC’s online service by Monday 21 January. This is because it can take up to seven working days to complete the process, as an Activation Code has to be posted to you. People who’ve filed online before, but have lost their password or user ID and need a replacement, should also contact HMRC by this date.

It’s easy to register – just visit www.hmrc.gov.uk/signup and follow the instructions. You’ll immediately get a User ID and, once you’ve received the Activation Code in the post, you can activate your account. You can then complete your tax return online.

With the clock ticking, small businesses that have to complete a return, such as sole traders and partnerships, are being offered the chance to participate in one of three HMRC interactive webinars on “How to complete your Self Assessment return online”.

Participants will be able to see a live presentation and ask questions online.

The webinars will take place on: Saturday 19 January (1100 – 1200); Tuesday 22 January (1400 – 1500); and Wednesday 30 January (0800 – 0900). To register for these free events, visit www.hmrc.gov.uk/webinars/live.htm

The end of January is also the deadline for paying any tax you owe for the 2011-12 tax year.

Further information on completing your tax return is available by visiting www.hmrc.gov.uk/sa or calling the Self Assessment helpline on 0845 9000 444.

Notes for editors

1. Around 10.6 million Self Assessment returns / notices to complete a tax return have been sent out by HMRC for the 2011-12 tax year.

2. Follow HMRC on Twitter @HMRCgovuk for all the latest news on Self Assessment.

3. Images of HMRC’s new “inner peace” Self Assessment ads are available from HMRC’s Flikr channel at www.flickr.com/hmrcgovuk

4. The penalties for late Self Assessment returns are: · an initial £100 fixed penalty, which applies even if there is no tax to pay, or if the tax due is paid on time; · after three months, additional daily penalties of £10 per day, up to a maximum of £900; · after six months, a further penalty of five per cent of the tax due or £300, whichever is greater; and · after 12 months, another five per cent or £300 charge, whichever is greater.

There are also additional penalties for paying late of five per cent of the tax unpaid at: 30 days; six months; and 12 months.

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.