Press release -

HMRC releases most optimistic Self Assessment expense claims

Glamorous holidays abroad, luxury watches and Friday nights out feature in HMRC’s latest list of the most outlandish expenses which customers tried to claim back on their 2014-15 Self Assessment returns. With a week to go until the 31 January deadline, HMRC is releasing the strangest expenses to ensure other customers don’t make similar claims:

- Holiday flights to the Caribbean

- Luxury watches as Christmas gifts for staff - from a company with no employees

- International flights for dental treatment ahead of business meetings

- Pet food for a Shih Tzu ‘guard dog’

- Armani jeans as protective clothing for painter and decorator

- Cost of regular Friday night ‘bonding sessions’ - running into thousands of pounds.

- Underwear - for personal use

- A garden shed for private use - plus the costs of the space it takes up in the garden

- Betting slips

- Caravan rental for the Easter weekend.

The expenses above were all rejected.

Ruth Owen, HMRC Director General of Customer Services, said:

“Year after year we receive a number of ludicrous expense claims, ranging from international holiday flights to expensive designer clothing, which we would never uphold. Why should the honest taxpayer pick up the bill for others? HMRC will only accept those claims which are genuine, such as legitimate travel expenses or the cost of tools for the job.

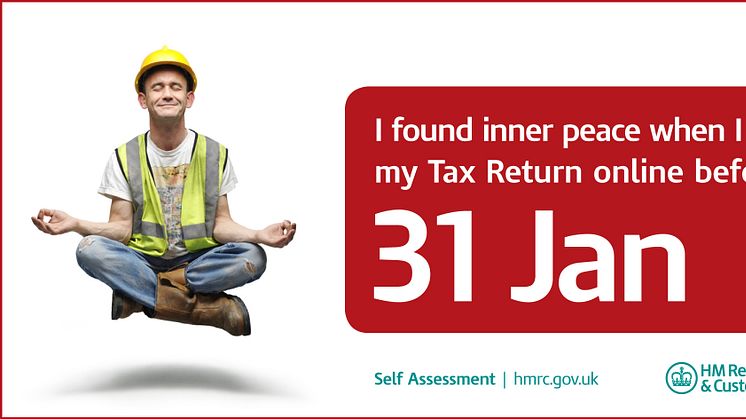

“The seven day countdown to the 31 January Self Assessment deadline is now on. Don’t delay and risk a penalty, the time to submit your tax return is now.”

Notes to editors

1. The deadline for Self Assessment returns is 31 January.

2. If you are submitting your 2015-16 Self Assessment return online for the first time, you will need to register for SA Online. Registering for online filing is simple – you can do it at: www.gov.uk/selfassessment

3. Help is available from the GOV.UK website at www.gov.uk/selfassessment or from the Self Assessment helpline on 0300 200 3310.

4. The penalties for late tax returns are:

- an initial £100 fixed penalty, which applies even if there is no tax to pay, or if the tax due is paid on time

- after three months, additional daily penalties of £10 per day, up to a maximum of £900

- after six months, a further penalty of 5% of the tax due or £300, whichever is greater

- after 12 months, another 5% or £300 charge, whichever is greater.

5. There are also additional penalties for paying late of 5% of the tax unpaid at 30 days, six months and 12 months.

6. Follow HMRC’s press office on Twitter @HMRCpressoffice.

7. HMRC's Flickr channel: www.flickr.com/hmrcgovuk.

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.