Press release -

Savers receive Help to Save bonus payment

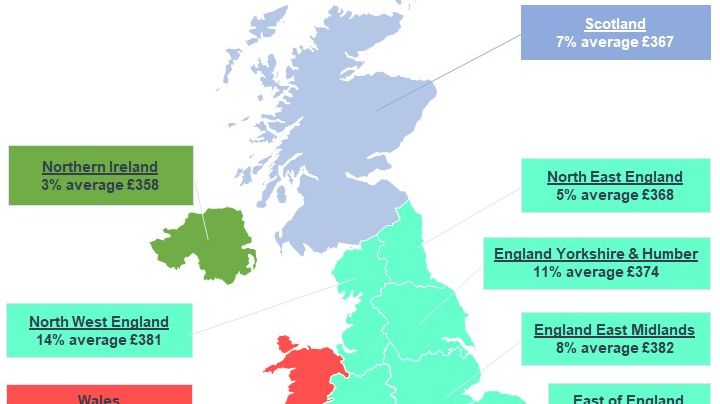

More than 60,400 savers across the UK have earned their first Help to Save bonus payment, each receiving an average of £378 in time for Christmas, HM Revenue and Customs (HMRC) can reveal.

Help to Save is the UK government backed saving scheme. It was launched in September 2018 to help those eligible save up to £50 a month in a secure savings account.

For every £1 saved, people can earn a bonus of 50 pence, over four years. The 50% bonus is payable at the end of the second and fourth years and is based on how much account holders have saved.

Karl Khan, HMRC’s Interim Director General for Customer Services, said:

“Help to Save rewards regular savers and the bonus payments can make a big difference to individuals and families.

“We’ve tried to make it as easy as we can for people to check if they qualify. It only takes a few minutes online – just search ‘help to save’ on GOV.UK.”

To date, savers have received more than £22.8 million in Help to Save bonuses, according to latest Management Information figures from HMRC. The data also shows:

- The North West has the highest number of savers who have paid into their accounts and received their first bonus payment (8,660)

- Savers in the South West received the highest average bonus payment (£397), followed by savers in Greater London (£385).

The first bonus payment has been paid to savers who created an account and started saving money two years ago. It is paid directly into the account holder’s chosen bank account.

Once savers have received their bonus payment at the two-year stage, they can continue to use the secure savings account to receive the final bonus payment at the four-year point. Savers can close their savings account at any time and withdraw any remaining funds. However, if they close their account early, they will miss their next bonus and will not be able to open a new account.

Eligible customers who have not already opened a Help to Save savings account can apply via GOV.UK.

People can open a Help to Save account if any of the following applies. They are:

- receiving Working Tax Credit

- entitled to Working Tax Credit and receiving Child Tax Credit

- claiming Universal Credit and they (with their partner if it’s a joint claim) earned £604.56 or more from paid work in their last monthly assessment period

Notes to Editors

1.Data is from HMRC’s Help to Save Management Information, up to and including 6 December 2020

2.The Regional breakdown for the data:

| Regions & Nations | Accounts that earned bonus (1) | Bonus paid (2) | AVG Bonus (3) | % of Accounts that earned a Bonus (4) |

| East of England | 4890 | £1,856,000 | £380 | 8% |

| England East Midlands | 4540 | £1,735,000 | £382 | 8% |

| England Greater London | 5180 | £1,995,000 | £385 | 9% |

| England North East | 3060 | £1,127,000 | £368 | 5% |

| England North West | 8660 | £3,297,000 | £381 | 14% |

| England South West | 5410 | £2,149,000 | £397 | 9% |

| England West Midlands | 5690 | £2,158,000 | £379 | 9% |

| England Yorkshire & Humber | 6600 | £2,466,000 | £374 | 11% |

| England South East | 6700 | £2,508,000 | £374 | 11% |

| Northern Ireland | 2050 | £733,000 | £358 | 3% |

| Wales | 3330 | £1,242,000 | £373 | 6% |

| Scotland | 4330 | £1,590,000 | £367 | 7% |

| Totals | 60410 | £22,857,000 | £378 | 100% |

1. Figures are rounded to the nearest 10.

2. Figures are rounded to the nearest 100.

3. Figures are rounded to the nearest £1.

4. Figures are rounded to the nearest whole number.

5. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.