Press release -

Scam HMRC call reports drop by 97%

Reports of scam HMRC phone calls have fallen by 97% over the last 12 months, latest HM Revenue and Customs (HMRC) figures show, which display a downward trend in reports overall throughout the past year.

Reports of scammers impersonating HMRC in phone calls peaked at 79,477 in March 2021 and fell to just 2,491 in December 2021.

The fall in scam call reports to HMRC has also been seen elsewhere with an 92% drop in phishing email reports and a 97% drop in scam text reports over the last year.

These significant results are testament to some of the work of teams across HMRC in tackling these attempts to defraud people, including dedicated customer protection teams and helplines, tools to refer scams, and use of innovative technologies. It also signals that the public is more aware of cyber criminals and the methods they use to trick people, in part thanks to HMRC’s awareness raising efforts, meaning fewer members of the public have been the subject of scammers and attempts to steal their money.

All of HMRC’s work to protect the public and make people aware of scams and the advice available on GOV.UK, has helped move HMRC from third most phished brand globally to outside the top 100.

Mike Fell, HMRC’s Head of Cyber Security Operations, said:

“We work incredibly hard to protect the public from these criminals who ruin lives by stealing from people. It’s great news that fewer people are receiving and reporting these attempted frauds, but it is still important they continue to report suspicious contact to us. We will continue to do everything we can to protect the public from these cynical attempts to impersonate HMRC to steal from people.

“Our advice is - never let yourself be rushed. If someone contacts you saying they are from HMRC, wanting you to urgently transfer money or give personal information, be on your guard. HMRC will never ring up threatening arrest, only criminals do that. Contacts like these should set alarm bells ringing, so take your time and check HMRC scams advice on GOV.UK.”

Some HMRC-themed scams originate abroad. HMRC works closely with national and international law enforcement agencies to combat scams, including collaboration with India as a key international partner in tackling the organised crime groups that run these scams. Work by the Indian authorities last year resulted in multiple arrests and the closure of criminal call centre operations. In June 2021, 51 people were arrested at two call centres in Delhi, India, that were dedicated to facilitating HMRC scams.

HMRC has a dedicated Customer Protection team working on cyber and phone crime around the clock, closing down scams and sharing intelligence with law enforcement agencies. HMRC also deploys innovative technologies to prevent misleading and malicious communications that impersonate its genuine e-mail channels, from ever reaching the public. Since 2017 these technical controls have allowed HMRC to prevent 500 million bogus emails reaching customers.

More recently, new controls have prevented 90% of the most convincing text messages from reaching the public and joint working with industry partners has prevented the spoofing of most of HMRC’s helpline numbers.

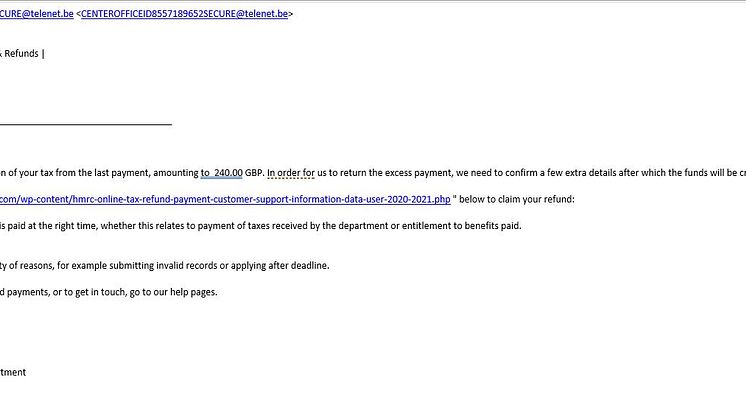

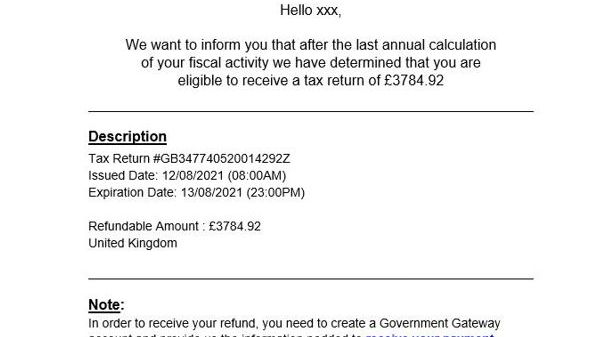

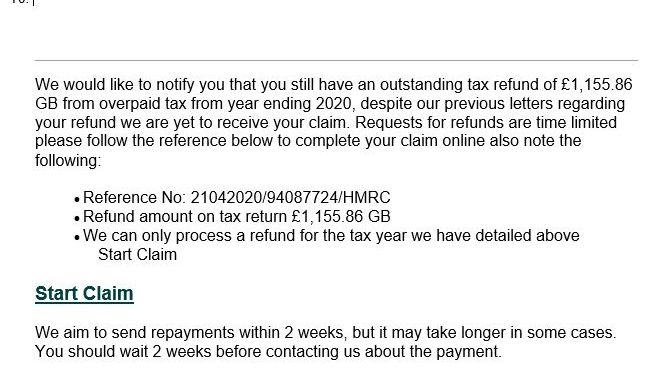

In the last year, HMRC has responded to 670,793 referrals of suspicious contact from the public, with 283,157 of these cases offering bogus tax rebates. Others threaten arrest for tax evasion or offer fake financial support.

As part of HMRC’s action to combat voice scams, the department has set up a direct referral route on GOV.UK where people can report HMRC-related telephone phishing.

HMRC also works with the telecoms industry to remove phone numbers being used to commit HMRC-related phone scams. In December 2021, four phone numbers being used to commit HMRC-related phone scams were removed, which is likely to have prevented hundreds of scam calls being made.

HMRC uses a range of modern methods when communicating with its customers. Criminals will often then try to duplicate those methods to take advantage of people. HMRC is doing everything it can to stay one step ahead of the criminals to keep its customers and their information safe.

Search ‘scams’ on GOV.UK for information on how to recognise genuine HMRC contact and how to avoid scams. Forward suspicious texts claiming to be from HMRC to 60599 and emails to phishing@hmrc.gov.uk. Report tax scam phone calls on GOV.UK.

Notes to Editors:

- HMRC’s scam advice is:

Stop:

- Take a moment to think before parting with your money or information.

- If a phone call, text or email is unexpected, don’t give out private information or reply, and don’t download attachments or click on links before checking on GOV.UK that the contact is genuine.

- Do not trust caller ID on phones. Numbers can be spoofed.

Challenge:

- It’s ok to reject, refuse or ignore any requests - only criminals will try to rush or panic you.

- Search ‘scams’ on GOV.UK for information on how to recognise genuine HMRC contact and how to avoid and report scams.

Protect:

- Forward suspicious texts claiming to be from HMRC to 60599 and emails to phishing@hmrc.gov.uk. Report tax scam phone calls on GOV.UK.

- Contact your bank immediately if you think you’ve fallen victim to a scam, and report it to Action Fraud (in Scotland, contact the police on 101).

2. Recent multi-agency law enforcement successes in fighting cyber crime:

- In 2021 HMRC helped Police on a number of text message and phishing cases. Teige Gallagher was sentenced in May 2021 for sending Covid, HMRC and bank-branded messages. He received a four-year custodial sentence.

- In June 2021 51 people were arrested at two call centres in Delhi, India, dedicated to HMRC scams.

3. Reports of scams are as of December 2021:

12 month rolling period

| Month | Phishing emails | SMS referrals | Phone scams | |

| Jan-21 | 46,210 | 26,643 | 33,053 | |

| Feb-21 | 38,505 | 12,593 | 43,992 | |

| Mar-21 | 42,425 | 6,308 | 79,477 | |

| Apr-21 | 33,380 | 1,988 | 66,819 | |

| May-21 | 11,677 | 1,839 | 32,129 | |

| Jun-21 | 14,748 | 1,122 | 18,109 | |

| Jul-21 | 16,953 | 757 | 12,037 | |

| Aug-21 | 18,691 | 723 | 3,269 | |

| Sep-21 | 12,422 | 366 | 2,272 | |

| Oct-21 | 4,639 | 530 | 1,803 | |

| Nov-21 | 6,307 | 777 | 1,278 | |

| Dec-21 | 3,737 | 717 | 2,491 | |

| Totals | 249,694 | 54,363 | 296,729 | 600,786 |

[Note: HMRC received 670,793 scam reports in total, 600,786 of these referred to tax scams specifically.]

4. The deadline for Self Assessment customers to complete their 2020/21 tax return and pay any tax owed is 31 January 2022.

Earlier this month, HMRC announced they would waive penalties for one month for late filing of tax returns and late payments. The changes mean:

- anyone who cannot file their return by the 31 January deadline will not receive a late filing penalty if they file by 28 February

- anyone who cannot pay their tax liabilities by the 31 January deadline will not receive a late payment penalty if they pay their tax in full, or set up a time to pay arrangement, by 1 April

Interest will be payable from 1 February on outstanding balances.

5. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Topics

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.