Twyllwr TAW i dalu £1.2m neu bydd yn wynebu rhagor o amser yn y carchar

Mae’n rhaid i dwyllwr sydd wedi’i garcharu, a brynodd dair fila yn Sbaen ar ôl dwyn mwy na £1.2 miliwn oddi ar drethdalwyr, dalu’r arian yn ôl neu bydd yn wynebu saith mlynedd arall yn y carchar.

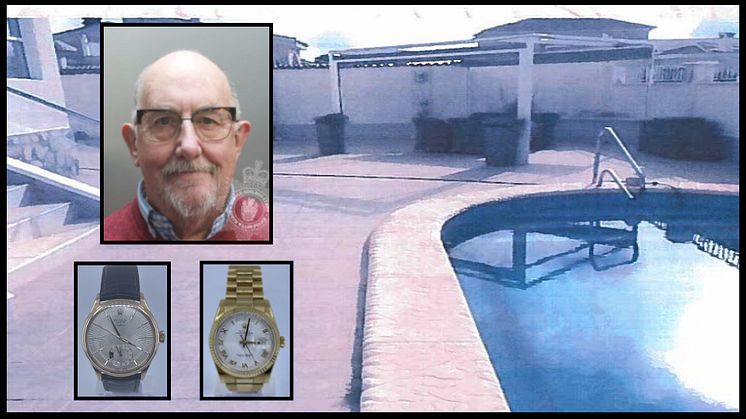

Cafodd Graham Drury, 71 oed, gynt o Strathalyn, Yr Orsedd, Wrecsam, ei garcharu am bum mlynedd a hanner yn 2021 ar ôl cyflwyno Ffurflenni TAW twyllodrus i Gyllid a Thollau EF (CThEF).

Mewn gwrandaw