Press release -

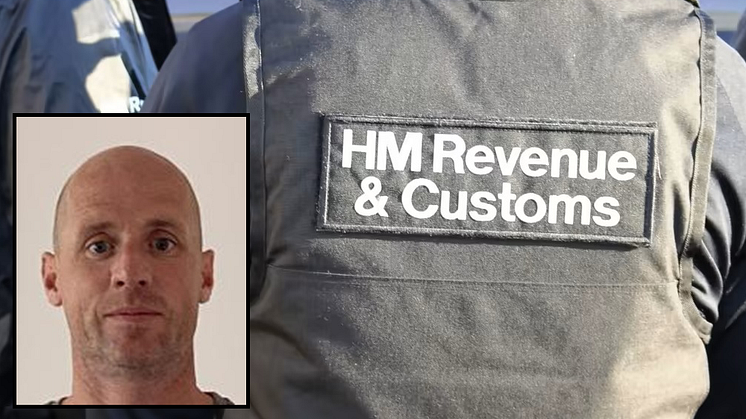

Tax stealing tiler sentenced

A tax stealing tiler has been sentenced for a £492,000 VAT fraud after ignoring a chance to come clean.

James Burton, who runs a tiling business in Northampton, was given the chance to make “full, open and honest” disclosures about his tax affairs to avoid criminal investigation.

But the 45-year-old ignored all contact from HM Revenue and Customs and claimed a letter sent to him, which had been signed for, had been lost in a drawer.

HMRC checks raised concerns over his tax affairs and he was offered the chance to correct them and pay what was owed plus a penalty through a civil Contractual Disclosure Facility (CDF), known as ‘COP9’.

The business owner, of Park Ave South, only contacted HMRC three months after the offer period had expired.

The case was referred for criminal investigation in December 2019 and he admitted five counts of tax fraud at Northampton Crown Court on 13 June 2022.

Nick Stone, Operational Lead, Fraud Investigation Service, HMRC, said:

“James Burton had the chance to do the right thing and put his tax affairs in order but has shown a disregard for the vast majority who pay what they owe.

“We want to help people get their taxes right and can offer people the chance to make full, open, and honest disclosures. If you engage in the process but lie you will also face prosecution.

“The consequences of not engaging are clear and they should be to others who are offered this opportunity.

“Anyone with information about suspected tax fraud can report it to HMRC online.”

Investigators discovered that Burton had submitted VAT returns with inflated payments on materials for his tiling firm between March 2014 and March 2018. He pocketed repayments he was not entitled to.

Confiscation proceedings to recover the stolen tax is now underway.

Notes for editors

- James Burton DOB: 22/08/1977, of Park Ave South, Northampton, admitted three counts of fraudulent evasion of income tax, contrary to section 106A of the Taxes Management Act (1970), one count of cheating the public revenue contrary to common law, and one count of fraudulent evasion of value added tax, contrary to section 72 of the Value Added Tax Act (1972), at Northampton Crown Court on 13 June 2022. He was sentenced to two years in prison, suspended for two years, at the same court on 09 August 2023.

- The total value of the fraud was £492,891.

- Code of Practice 9 (COP9) is the civil investigation procedure that HMRC follows to respond to tax fraud. It is HMRC’s main tool for investigating cases of suspected tax fraud when a civil procedure is considered to be the most appropriate action.

- Under the investigation of fraud procedure, the recipient of COP9 is given the opportunity to make a complete and accurate disclosure of all their deliberate and non-deliberate conduct that has led to irregularities in their tax affairshttps://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/494808/COP9_06_14.pdf

- The Contractual Disclosure Facility (CDF) is part of the process used to deliver COP9. It is a contractual arrangement whereby HMRC undertakes not to criminally investigate, in return for the customer’s open full, open, and honest disclosure of all the tax fraud committed.

- Find out more about HMRC's approach to tax fraud at gov.uk.

- Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.