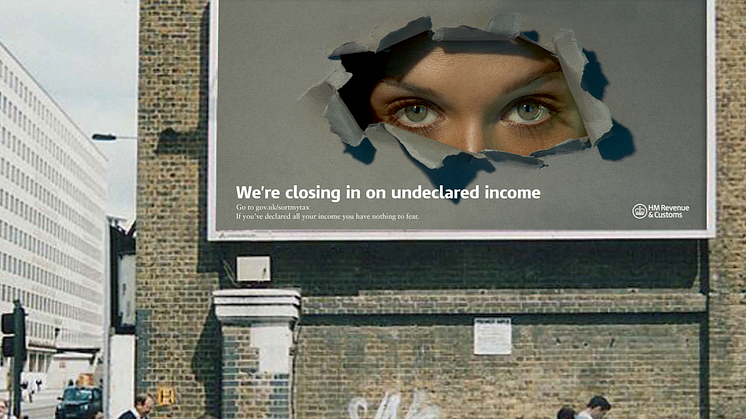

HMRC closes in on tax cheats

An advertising campaign warning tax cheats to declare all their income before it is too late was launched today by HM Revenue & Customs (HMRC).

An advertising campaign warning tax cheats to declare all their income before it is too late was launched today by HM Revenue & Customs (HMRC).

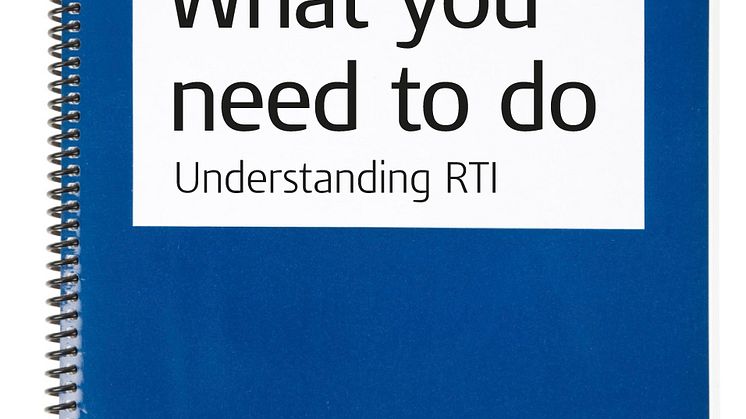

Up to 250,000 employers are set to join the Real Time Information in PAYE (RTI) pilot between now and 31 March 2013.

Business Records Checks are being re-launched by HM Revenue and Customs (HMRC) today, following a review and extensive stakeholder consultation.

If you haven’t yet sent in your 2011/12 tax return, you must send it online if you want to avoid a penalty, as the 31 October deadline for paper returns has now passed.

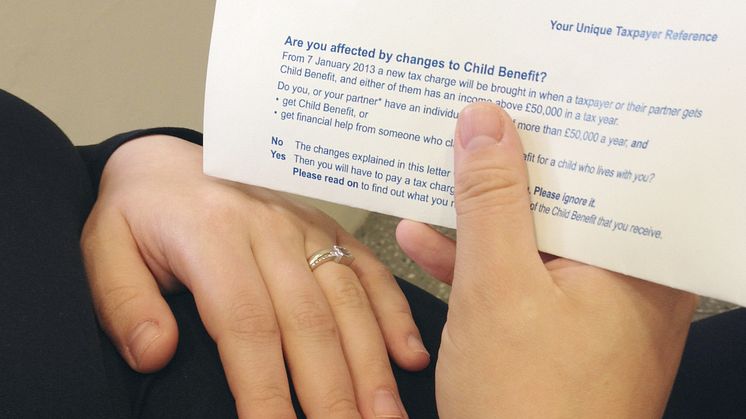

Around one million letters will be issued during November to families affected by next year’s changes to Child Benefit.

Figures released by HM Revenue and Customs (HMRC) today estimate the tax gap for 2010/11 at £32 billion, or 6.7 per cent of tax due, compared to 7.1 per cent in 2009/10.

There are just days left to send your 2011/12 paper tax return to HM Revenue & Customs (HMRC), if you want to beat the 31 October deadline and avoid a penalty.

HM Revenue & Customs (HMRC) is reminding anyone sending their 2011/12 tax return on paper that they need to do so by the 31 October deadline, if they want to avoid a penalty.

HM Revenue & Customs (HMRC) is kicking off its Real Time Information (RTI) awareness campaign next month. This includes writing to over 1.4 million employers.

Small and medium-sized firms are being invited by HM Revenue and Customs (HMRC) to sign up to receive regular emails giving help and support.

HM Revenue and Customs (HMRC) has become the first Government department to sign a contract for the delivery of G-Cloud Services over the Public Services Network.

People selling directly to customers and who haven’t paid all the tax they owe have been offered the opportunity to come forward and pay up under an HM Revenue & Customs (HMRC) campaign.