HMRC’s achievements

HM Revenue and Customs (HMRC) has had a very successful year with record-breaking and sustained results through 2015 by increasing revenues, reducing costs and improving customer service.

HM Revenue and Customs (HMRC) has had a very successful year with record-breaking and sustained results through 2015 by increasing revenues, reducing costs and improving customer service.

HM Revenue and Customs (HMRC) is boosting its online protection and urging all customers to keep their personal details safe online, when completing their Self Assessment return.

UK taxpayers will now be able to manage their tax affairs online with the official launch of Personal Tax Accounts.

The deadline for 2014-15 Self Assessment filing is fast approaching and HMRC is urging all customers to find their inner peace by returning theirs before the 31 January.

More than 85% of customers chose to submit their return online last year, the service is quick, easy and has a wide range of support resources available, such as web chat.

If you’re filing online for the first time, you w

Adult club owners and adult entertainers who don’t pay their taxes are being targeted by a new UK-wide taskforce launched today by HM Revenue and Customs (HMRC).

High street bookies Ladbrokes has lost a £54m tax avoidance court case.

HM Revenue and Customs will start sending letters this week to potential Scottish taxpayers as part of the next stage of preparations for the introduction of the Scottish Rate of Income Tax.

The Financial Secretary to the Treasury, David Gauke, today launched a campaign warning offshore tax evaders that HMRC will start to receive details on UK taxpayers from more than 90 countries, under new global agreements championed by the UK.

HMRC has today announced the next step in its ten-year modernisation programme to create a tax authority fit for the future, committing to high-quality jobs and the creation of 13 new regional centres over the next five years, serving every nation and region in the UK.

In a major boost for pioneering small businesses, the Financial Secretary to the Treasury, David Gauke, today launched a new plan outlining how government will make it easier for small businesses investing in research and development to claim tax relief.

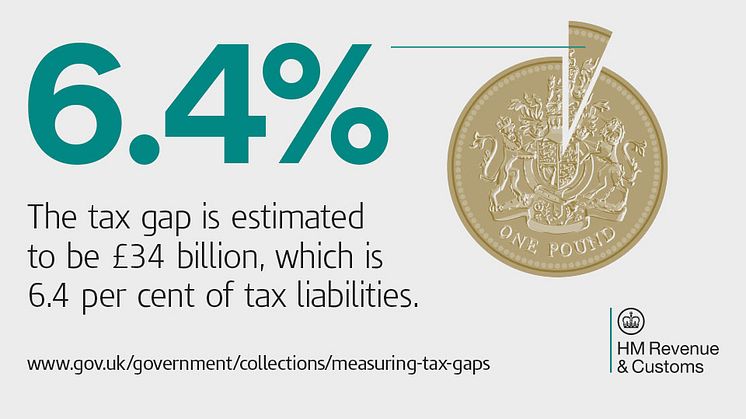

The tax gap for 2013-14 was 6.4 per cent of tax due, continuing a long-term downward trend, reflecting that HM Revenue and Customs’ (HMRC) approach is delivering steady and sustained progress.

HM Revenue and Customs (HMRC) taskforces have brought in £109 million in the last six months it was revealed today. That includes £64.9 million recovered in the first three months of this year, more than double the figure for the same period in 2014.