Take the stress out of school holidays – government help with childcare

Almost a third of parents in Great Britain (31%) feel stressed trying to arrange childcare for the school holidays according to a new YouGov poll out today.

Almost a third of parents in Great Britain (31%) feel stressed trying to arrange childcare for the school holidays according to a new YouGov poll out today.

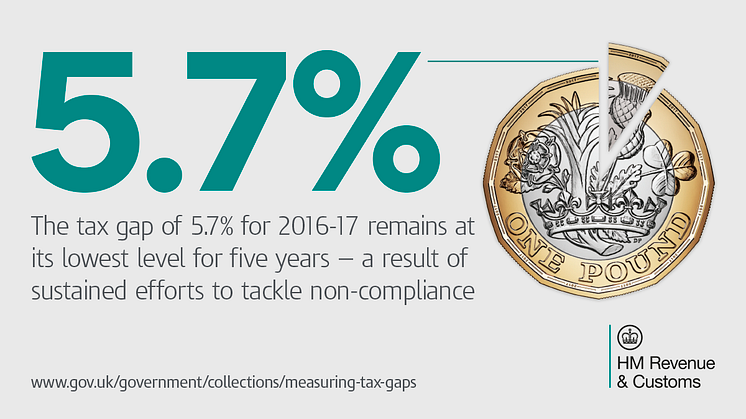

The tax gap for 2016/17 is 5.7%, HM Revenue and Customs (HMRC) confirmed today.

HMRC has revealed today that it has saved the public over £2.4m by tackling fraudsters that trick the public into using premium rate phone numbers for services that HMRC provide for free.

HM Revenue & Customs (HMRC) has more than doubled the number of underpaid workers getting the money they’re owed under the National Minimum Wage, according to latest figures.

HMRC is calling on people to stay vigilant in the fight against fraudsters, who are using email and text messages to scam them out of their savings.

HMRC has processed 10 million transactions using robots since 2015 which has improved efficiency and customer experience.

From 1 April 2018, Landfill Tax is changing to include disposals at unauthorised waste sites in England and Northern Ireland. These changes will support legitimate waste management businesses by creating a fairer tax system and a deterrent to causing environmental harm by disposing of material at an unauthorised waste site.

Datganodd CThEM heddiw bod rhaglen addysgiadol rhad ac am ddim, sy'n cynnig cyflwyniad syml i dreth ar gyfer plant ysgolion cynradd, ar gael yn awr i blant Cymraeg.

A free education programme offering a simple introduction to tax for primary school children is now available for Welsh speaking students, HM Revenue and Customs announced today.

World-leading powers to ensure online sellers pay the right tax and don’t leave law-abiding high street and online businesses at a disadvantage, have come into force today. These were first announced by the Chancellor at Autumn Budget 2017.

HMRC wins tax avoidance case worth £55 million.

Time is running out for anyone with offshore assets before tougher penalties kick in, as HM Revenue and Customs (HMRC) publishes proposals to allow more time to investigate when someone hasn’t declared the right amount of tax.