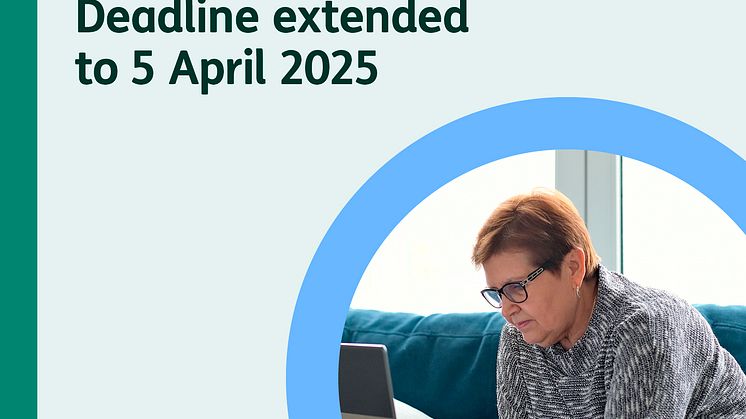

Deadline for voluntary National Insurance contributions extended to April 2025

Taxpayers now have until 5 April 2025 to fill gaps in their National Insurance record from April 2006 that may increase their State Pension - an extension of nearly two years - the government announced today (12 June).