Press release -

Number of Self Assessment customers who file early doubles in 5 years

The number of Self Assessment customers who choose to file their tax return on the first day of the tax year (6 April 2023) has more than doubled since 2018, HM Revenue and Customs (HMRC) has revealed.

More than 77,500 customers submitted their tax return for the 2022 to 2023 tax year on 6 April 2023, compared to almost 37,000 customers on 6 April 2018.

The deadline to file tax returns for the 2022 to 2023 tax year is 31 January 2024 and customers have been able to submit theirs since the start of the new tax year.

By completing their Self Assessment early, customers have avoided the stress of last-minute filing – something which encouraged more than 860,000 customers file their tax return for the 2021 to 2022 tax year on 31 January 2023.

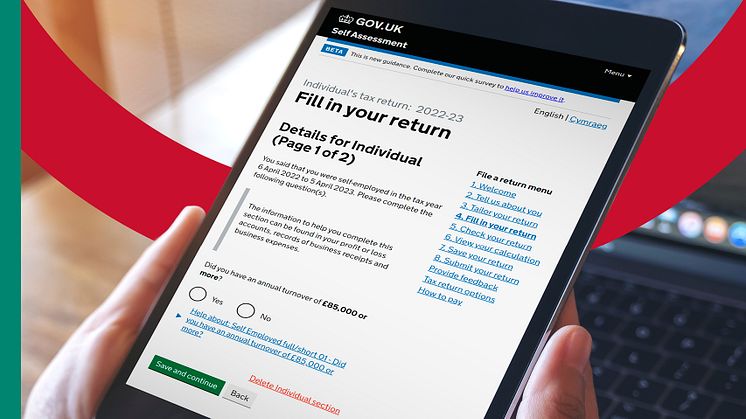

Visit GOV.UK to find out more about Self Assessment and how to file a tax return for the 2022 to 2023 tax year.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“Filing your Self Assessment early means you can spend more time building your business or doing the things that you enjoy and less time worrying about completing your tax return. To find out how you can start yours and get help with budget planning, search ‘Self Assessment’ on GOV.UK.”

Customers can find out sooner if they are owed money. Once they have submitted their tax return for the 2022 to 2023 tax year, HMRC will let customers know as soon as the return has been processed and arrange for any overpayment to be refunded. Customers can also check if they are due a refund in the HMRC app once they have filed their return.

Customers who file early also benefit from knowing how much tax they owe and can set up a budget plan to help spread the cost and manage their payments. The Budget Payment Plan allows customers to choose how much and how often they want to pay – putting them in control of managing their bill.

Taxpayers can check if they need to complete a tax return by using the free online tool on GOV.UK. They may need to do Self Assessment if, for example, they:

- are newly self-employed and have earned over £1,000

- are a new partner in a business partnership

- have received any untaxed income

- are claiming Child Benefit and you or your partner have an income above £50,000

HMRC has updated guidance on filing tax returns early and help around paying tax bills on GOV.UK.

It is important that customers let HMRC know if there are any changes in details or circumstances such as a new address or name, or if they are no longer self-employed or their business has closed down. They should not assume someone else will update HMRC on their behalf.

If customers no longer need to do Self Assessment, they will need to tell HMRC. Find out more information on YouTube.

HMRC is reminding customers to protect their personal information and always be on their guard against tax scams. If a customer is contacted by someone saying they are from HMRC, they should never let themselves be rushed, especially if they are urged to transfer money or share personal information. Customers should not share their HMRC login details with anyone, including their tax agent. Tax scams come in many forms – some offer a rebate while others threaten arrest for tax evasion. HMRC advises customers to take their time and if they’re unsure, check HMRC scams advice on GOV.UK.

Notes to Editors

1. Filing figures for the first day of the tax year:

Date | Online returns received (and corresponding tax year) |

6 April 2018 | 36,939 (2017/18) |

6 April 2019 | 35,255 (2018/19) |

6 April 2020 | 96,519 (2019/20) |

6 April 2021 | 63,521 (2020/21) |

6 April 2022 | 66,465 (2021/22) |

6 April 2023 | 77,517 (2022/23)* |

*This figure does not include amendments or returns filed for previous years.

2. Visit GOV.UK for a full list of ways to pay Self Assessment tax bills.

3. Almost 97% of customers now file their Self Assessment tax returns online. We no longer automatically issue paper returns unless there’s a reason you can’t file online. If you need a paper form, call HMRC and request form SA100. We may ask you about your reasons for not filing online, so we can tell you about the support we can offer you.

4. HMRC wants to help you get your tax right. There’s lots of information and support you can access online without ringing us:

- HMRC’s digital assistant - the assistant will help you find information, and if you can’t find what you’re looking for you can ask to speak to an adviser.

- guidance notes and help sheets and YouTube videos provide a wealth of information if you’re stuck or confused.

- live webinars where you can ask questions or if you can’t join, you can watch recorded webinars on demand.

- HMRC app and Personal Tax Account - you can instantly find your Unique Taxpayer Reference, make a Self Assessment payment, get your National Insurance number and get your employment income and history for your tax return.

- technical support for HMRC online services for help signing into online services

- email updates - subscribe to HMRC email updates so you don’t miss out on the latest information on Self Assessment.

- social media updates - follow HMRC Twitter @HMRCcustomers to get the latest updates on Self Assessment services and useful reminders.

- if you need extra support to help your with Self Assessment you can contact a voluntary or community sector organisation who can provide you with help and advice, or you can get support directly from HMRC.

5. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

- Self Assessment tax returns

- Pay your Self Assessment tax bill

- Check if you need to send a Self Assessment tax return

- File your tax return early

- Tell HMRC about a change to your personal details

- Stop being self-employed

- How do I cancel my Self Assessment registration?

- Report suspicious HMRC emails, text messages and phone calls

- Pay your Self Assessment tax bill

- Self Assessment tax return forms

- Download the HMRC app

- Help and support email service

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.