Charities get online Gift Aid service

Claiming gift aid repayments will be quicker and easier for charities and sports clubs from April, HM Revenue and Customs (HMRC) said today.

Claiming gift aid repayments will be quicker and easier for charities and sports clubs from April, HM Revenue and Customs (HMRC) said today.

Real Time Information (RTI) will be better for employers, better for employees and better for Britain. It is time we replaced a tax reporting system that is not fit for purpose.

Over 400 applications have been received by HM Revenue and Customs Alternative Dispute Resolution Service (ADR).

A new tax regime for businesses operating gaming machines comes into effect on 1 February 2013.

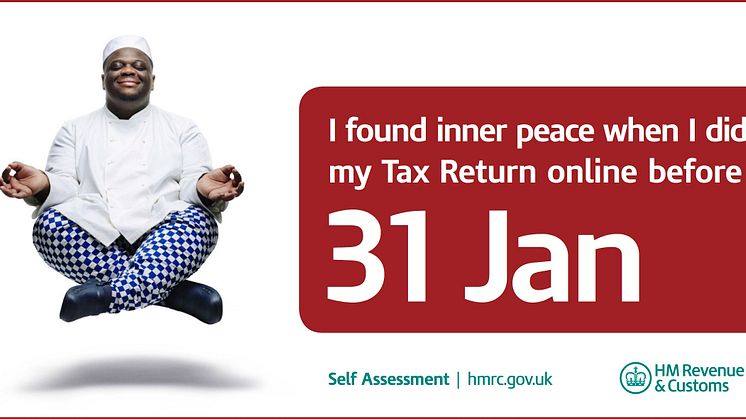

A record 9.61 million people found “inner peace” and sent their tax return on time this year, HM Revenue and Customs (HMRC) revealed today.

The ground breaking tax agreement between the UK and Switzerland which came into force on 1 January 2013 has delivered £342 million as the first tranche of revenue to the UK.

People selling directly to customers and who haven’t paid all the tax they owe have one month to come forward and pay up under an HM Revenue and Customs (HMRC) campaign.

If you still haven’t sent in your 2011-12 Self Assessment tax return, you’ve got just a few days left to do so and avoid a penalty.

Grants of £2 million to voluntary and community organisations to help people with taxes, benefits and tax credits led to £26 million in additional tax being declared to HM Revenue and Customs (HMRC) last year.

HM Revenue and Customs (HMRC) has announced the appointment of three new non-executive board members, as part of its ongoing governance arrangements.

A tax avoidance scheme, designed to abuse rules set up to encourage genuine medical research, has been successfully challenged by HM Revenue and Customs (HMRC) in court.

The countdown has begun to the 31 January Self Assessment deadline, with just days left for anyone with an outstanding 2011-12 tax return to send it online to HM Revenue and Customs (HMRC).

Thinking of setting up your own business or considering self-employment? Follow HM Revenue and Customs’ simple, 10-step guide to setting up as a sole trader.

With the biggest shake-up to Pay As You Earn (PAYE) in nearly seventy years about to start in April, we look at some interesting facts about PAYE.

Over 250,000 people have downloaded HM Revenue and Customs’ tax calculator app which allows people to work out how much tax they pay and how the Government spends it.

As many as 50,000 businesses that have failed to submit VAT returns will be targeted by HM Revenue and Customs (HMRC) this month with warnings that their tax affairs will be closely scrutinised.

Employers are being urged by HM Revenue and Customs to get ready for major PAYE changes that come into effect in three months’ time.

As the 31 January filing deadline is just weeks away, HM Revenue and Customs (HMRC) is calling on anyone who hasn’t sent in their 2011-12 tax return to do it now – and find “inner peace”.

While millions of people were exchanging presents, feasting on turkey, and nodding off in front of the television, 1,548 people decided to take time out from the yuletide festivities and do their tax return online – a 40 per cent increase on Christmas Day 2011, when 1,100 people filed online.

New rules that will lift the administration burden for charities claiming Gift Aid on the proceeds of donors’ goods sold by charity shops have been announced by HM Revenue and Customs (HMRC).