Payment policy nets more than £4bn from tax avoiders

HM Revenue and Customs (HMRC) has collected more than £4 billion through the ‘pay now, dispute later’ rules for people who have used a tax avoidance scheme.

HM Revenue and Customs (HMRC) has collected more than £4 billion through the ‘pay now, dispute later’ rules for people who have used a tax avoidance scheme.

HM Revenue and Customs (HMRC) has today published its 2016-17 annual report.

HM Revenue and Customs (HMRC) has launched a new hotline for the public to report fraud and evasion in the fight against tax fraud.

The HMRC Fraud Hotline - on 0800 788 887 – is open between 8am - 8pm seven days a week, 365 days a year.

This service will replace the two separate tax evasion and customs hotlines with one, streamlining HMRC’s intelligence gathering on tax fraud.

Customers

1 April 2017 marked the launch of an online service that will allow those who purchase alcohol for onward sale to check that their UK wholesaler is approved under the Alcohol Wholesale Registration Scheme (AWRS).

HM Revenue & Customs (HMRC) has won a tax avoidance case against film partnership schemes that acquired interests in films that included The Queen and the Roman Polanski remake of Oliver Twist, protecting more than £26m of taxpayers’ money.

Ladbrokes has lost a long running legal battle with HM Revenue and Customs (HMRC), costing the high street bookie £71 million.

Hard-core tobacco smugglers and people who repeatedly smuggle, distribute and sell illicit tobacco could be hit by a fourfold increase in fines together with tough new civil penalties, as part of plans to crackdown on the smuggling of illicit tobacco.

More information has been published today on how businesses, the self-employed and landlords will benefit from government plans to modernise the tax system.

Following extensive consultation, with more than 3,000 responses over the last eight months, HMRC has issued in-depth details on how digitising the tax system through its flagship Making Tax Digital project will help millions of businesses

In response to the Public Accounts Committee's report 'Collecting tax from high net worth individuals' released on 27 January 2017, HMRC has issued the following statement:

“The vast majority of people in the UK pay all the tax they owe and today the top one per cent of earners pay more than quarter of all income tax. There is absolutely no special treatment for the wealthy, and in fact we give

Ahead of the 31 January deadline, HMRC has released its latest list of the most outlandish items which have been claimed as expenses.

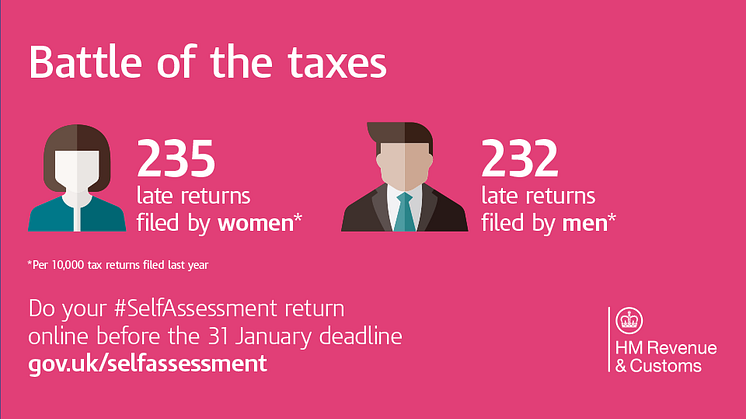

Men, for the second year running, were more likely than women to complete their tax return on time, winning the battle of the taxes once again - but only just.

More than 1.3 million couples across the UK have boosted their finances with Marriage Allowance, HM Revenue and Customs (HMRC) has announced today.

Each year HM Revenue and Customs (HMRC) receives a number of unusual excuses why Self Assessment (SA) customers didn’t complete their tax return on time.

More than seven million customers have used their online Personal Tax Account in its first year, HM Revenue and Customs (HMRC) announced today.

HMRC has successfully reduced the number of phishing emails its customers receive by 300 million this year, better protecting taxpayers from fraud and identity theft.

HM Revenue and Customs (HMRC) is today urging first-time Self Assessment (SA) customers to register for a Personal Tax Account (PTA), and see how easy submitting a tax return really can be.

HM Revenue and Customs (HMRC) and Concentrix have agreed to end, with immediate effect, the contract through which Concentrix provided additional capacity to check tax credits claims and reduce error and fraud in the system.

The UK tax gap fell in 2014-15 to its lowest-ever level of 6.5%, official statistics published today reveal.

HMRC has won its tenth successive case against tax avoidance schemes promoted by NT Advisors.

HM Revenue and Customs (HMRC) has confirmed today that it has decided not to extend its existing contract with Concentrix, a company it employs to check tax credits entitlement.