More than 63,500 file Self Assessment on first day of tax year and HMRC urges others to follow

More than 63,500 customers filed their 2020/21 tax return online on 6 April, HM Revenue and Customs (HMRC) has revealed.

More than 63,500 customers filed their 2020/21 tax return online on 6 April, HM Revenue and Customs (HMRC) has revealed.

HM Revenue and Customs (HMRC) is accepting tax relief claims for working from home due to coronavirus during 2021/22. More than 550,000 employed workers have already claimed and are benefitting from the tax relief.

HM Revenue and Customs (HMRC) is sending out about 2.5 million annual renewals packs to tax credits customers from this week. Customers should check their details in the renewal pack and report any change in circumstances to HMRC.

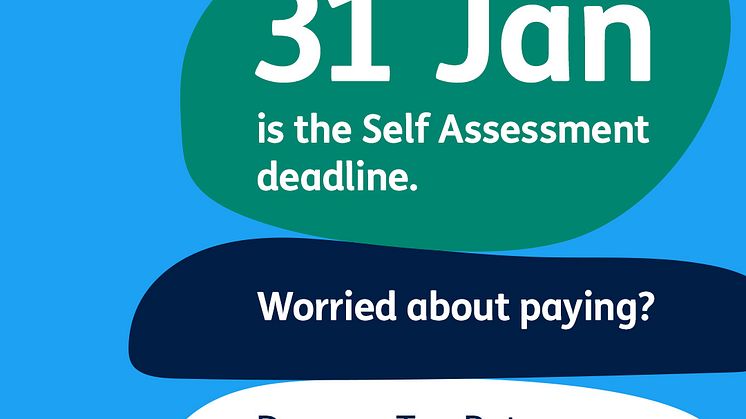

Self Assessment taxpayers have just over a week to pay any outstanding tax liabilities in full or set up an online payment plan for the 2019 to 2020 financial year to avoid incurring penalty charges, HM Revenue and Customs (HMRC) has urged.

Families using their Tax-Free Childcare accounts to pay for their childcare costs are benefitting from a government top-up worth up to £500 every three months, HM Revenue and Customs (HMRC) has announced.

More than 264,000 individuals have opened a Help to Save account and could be earning money on their savings, statistics from HM Revenue and Customs (HMRC) have revealed.

Over half a million businesses who deferred VAT payments last year can now join the new online VAT Deferral New Payment Scheme to pay it in smaller monthly instalments, HMRC has announced today (23 February).

Self Assessment taxpayers have less than one week to submit their late tax returns to prevent a £100 penalty, HM Revenue and Customs (HMRC) has urged.

Self Assessment taxpayers will not be charged a 5% late payment penalty if they pay their tax or set up a payment plan by 1 April, HM Revenue and Customs (HMRC) has announced.

HM Revenue and Customs (HMRC) is encouraging married couples and people in civil partnerships to sign up for a tax break this year.

More than 10.7 million people submitted their 2019/20 Self Assessment tax returns by the 31 January deadline, HM Revenue and Customs (HMRC) has revealed.

Self Assessment customers will not receive a penalty for their late online tax return if they file by 28 February, HM Revenue and Customs’ Chief Executive Jim Harra has announced.

Did you know almost 100,000 people filed their tax returns on 6 April 2020, which is the first day of the tax year? With the 31 January deadline fast approaching, HM Revenue and Customs (HMRC) shares some little-known facts about Self Assessment tax returns.

Almost 25,000 Self Assessment customers have set up an online payment plan to manage their tax liabilities in up to 12 monthly instalments, totalling £69.1 million, HM Revenue and Customs (HMRC) has revealed today.

A money service business (MSB) has been hit with a record £23.8 million fine for flouting money laundering regulations.

Around 5.4 million Self Assessment customers have less than a month to complete their tax return, HM Revenue and Customs (HMRC) announced today, ahead of the deadline on 31 January.

More than 2,700 customers filed their Self Assessment tax return on Christmas Day, HM Revenue and Customs (HMRC) can reveal.

More than 60,400 savers across the UK have earned their first Help to Save bonus payment, each receiving an average of £378 in time for Christmas, HM Revenue and Customs (HMRC) can reveal.

Traders are being urged to consider whether they need to sign up to the new UK Trader Scheme (UKTS) to ensure traders don’t pay tariffs on the movement of goods into Northern Ireland from Great Britain where those goods can be shown to remain the UK’s customs territory from 1 January.

HM Revenue and Customs (HMRC) and the Advertising Standards Authority (ASA) have today launched new action to cut out misleading marketing by promoters of tax avoidance schemes.

The joint enforcement notice aims to disrupt the activity of promoters and protect people from being presented with misleading adverts which may tempt them into tax avoidance.

It requires promoters to be clear abou