HMRC urges loan scheme users to come forward now

HMRC is encouraging users of disguised remuneration (DR) schemes to come forward to settle their tax debt by 5 April.

HMRC is encouraging users of disguised remuneration (DR) schemes to come forward to settle their tax debt by 5 April.

The Supreme Court today ruled against users of a failed tax avoidance film partnership scheme which tried to use legitimate investment in the film industry as a hook for tax avoidance.

HMRC taskforces have recovered more than £500 million since they were launched five years ago.

The Bank of Ireland has lost a £27m tax avoidance case after trying to exploit a loophole that did not exist.

HMRC has protected £365 million in tax after defeating a tax avoidance scheme that involved dividends paid on shares to a company based in the Cayman Islands.

The First-tier Tribunal ruled that the Clavis Liberty Fund 1 LP scheme, created an artificial tax loss - in a judgment covering 99 partners and protecting tax at stake in other cases.

The judgment is significant for HMRC as it is the f

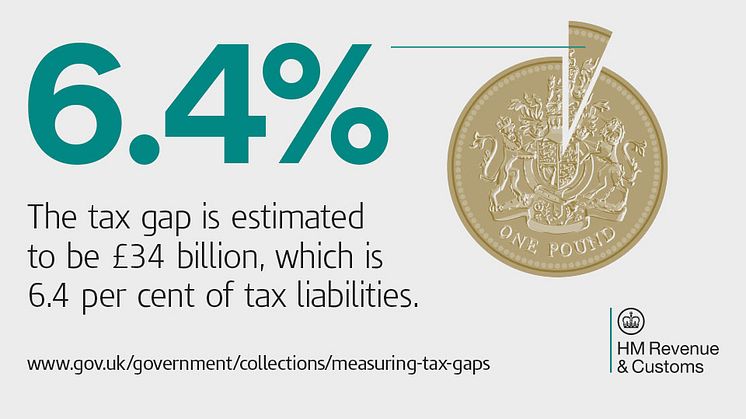

The tax gap for 2013-14 was 6.4 per cent of tax due, continuing a long-term downward trend, reflecting that HM Revenue and Customs’ (HMRC) approach is delivering steady and sustained progress.

Today the government is taking further tough action to crack down on tax avoidance promoters.

The tax gap, which is the difference between the amount of tax due and the amount collected, was 6.8% of tax liabilities, or £34 billion, in 2012-13.

A tax avoidance scheme which abused the reliefs offered for research into life-saving vaccines to claim back £77 million in tax has been rejected again by a tribunal.

HM Revenue and Customs (HMRC) is today giving around 16,000 tax avoidance scheme users the opportunity to pay the tax they owe or risk facing bigger tax bills and heavy legal costs.

The High Court has thrown out an attempt to challenge legislation introduced to tackle Stamp Duty Land Tax (SDLT) avoidance.

Another attempted abuse of the tax relief available when shares are gifted to charities has been blocked by a tribunal.

A tax avoidance scheme designed to make taxable interest payments disappear has been blocked for the second time by a tax tribunal.

A tax avoidance scheme sold by serial avoidance promoter NT Advisors has lost its third bid for legitimacy, saving the country £100 million.

A tax tribunal ruling against an income tax avoidance scheme is expected to protect up to £400 million in tax that would otherwise not have been paid.

A tax tribunal has ruled that PAYE tax and National Insurance Contributions should have been paid on bonuses given to directors through companies which were specially set up just to be liquidated and pay out the cash.

A tax avoidance scheme, designed to abuse rules set up to encourage genuine medical research, has been successfully challenged by HM Revenue and Customs (HMRC) in court.