Directors planned £20m tax fraud at secret meetings

A network of corrupt company directors has been jailed for more than 70 years after they were caught planning an elaborate multi-million-pound tax fraud during clandestine meetings.

A network of corrupt company directors has been jailed for more than 70 years after they were caught planning an elaborate multi-million-pound tax fraud during clandestine meetings.

More than £1.1million has been seized following a raid on a Money Service Business (MSB) in London.

A money launderer who fled during his 2018 trial has been extradited from the Netherlands and jailed for five-and-a-half years. Javed Ahmad was caught trying to stuff more than £100,000 in a filing cabinet when HM Revenue and Customs (HMRC) officers raided his Burnley office in November 2015.

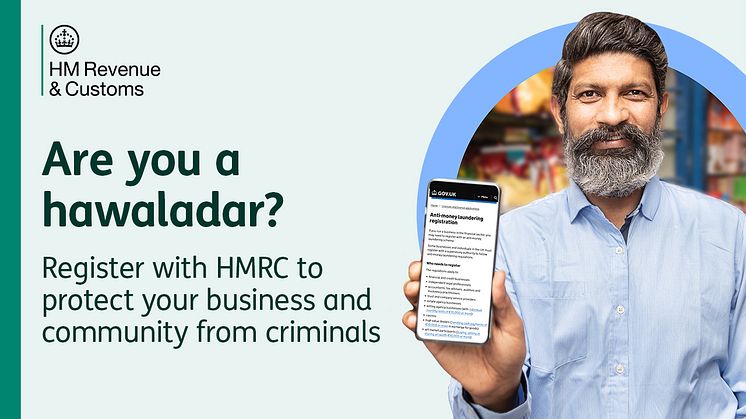

Criminals are exploiting informal money transfer services in the UK to launder an estimated £2 billion annually, concealing the proceeds of serious organised crime that harms communities. HMRC is urging businesses that offer these services – which help diaspora communities send money to relatives abroad – to register for anti-money laundering supervision to protect themselves from criminals.

A former accountant of a national children’s charity has been jailed for 10 years for using his knowledge of the sector to steal £1.5 million through fraudulent Gift Aid claims.

A sacked HM Revenue and Customs (HMRC) officer who abused her position to help her husband launder £3.3 million of criminal cash has been sentenced.

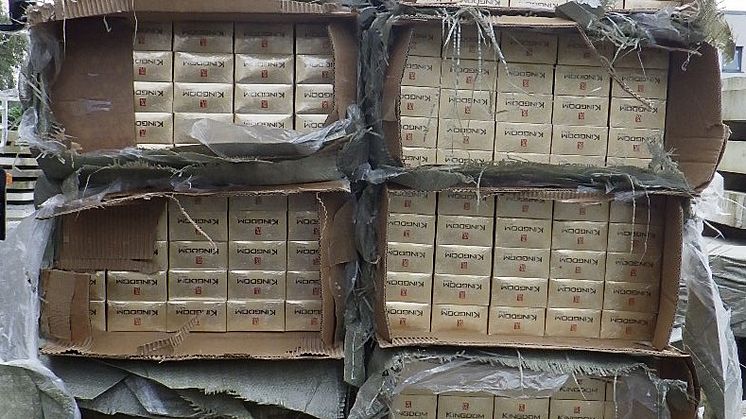

Four men have been arrested after the seizure of more than 11 million cigarettes in South Armagh.

The directors of a Leicester clothing company that supplied well known high street and online retailers have been jailed for a £1.3 million tax fraud.

Hundreds of businesses fined a total of £3.2 million for breaching anti-money laundering rules have been named by HM Revenue and Customs (HMRC).

The 240 supervised businesses named today were fined between 1 July and 31 December 2022 by HMRC for breaching Money Laundering Regulations aimed at preventing criminals from exploiting illicit cash.

Certain types of business are required to regist

A former West Yorkshire town councillor has been jailed for trying to steal more than £430,000 through the Government’s Eat Out to Help Out scheme.

Mohammed Ikram, 36, of Springfield Court, Keighley, admitted stealing money from the Covid-19 support schemes, following an investigation by HM Revenue and Custom’s (HMRC) Taxpayer Protection Taskforce.

He used his own café and takeaway business

Two men have been arrested as part of a multi-million-pound tax fraud investigation involving UK customers of a collapsed Puerto Rican bank.

HM Revenue and Customs (HMRC) officers executed search warrants at three residential and business addresses in Liverpool and arrested two men, aged 40 and 50.

Computers and other digital devices were seized during the raids along with business record

Hundreds of UK customers of a collapsed Puerto Rican bank linked to tax evasion and money laundering are being given a chance to check and correct their tax affairs. HM Revenue and Customs (HMRC) is currently writing to around 600 people in the UK who used the Euro Pacific Bank (EPB) urging them to check their tax position and make any corrections to their tax affairs.

The Financial Secretary to the Treasury, Mel Stride MP, has underscored his commitment for the UK to lead the fight against organised tax fraud and evasion in a visit to HMRC’s fraud investigation and intelligence teams on 14 March.