Updated tax app launched

Over 250,000 people have downloaded HM Revenue and Customs’ tax calculator app which allows people to work out how much tax they pay and how the Government spends it.

Over 250,000 people have downloaded HM Revenue and Customs’ tax calculator app which allows people to work out how much tax they pay and how the Government spends it.

As many as 50,000 businesses that have failed to submit VAT returns will be targeted by HM Revenue and Customs (HMRC) this month with warnings that their tax affairs will be closely scrutinised.

Employers are being urged by HM Revenue and Customs to get ready for major PAYE changes that come into effect in three months’ time.

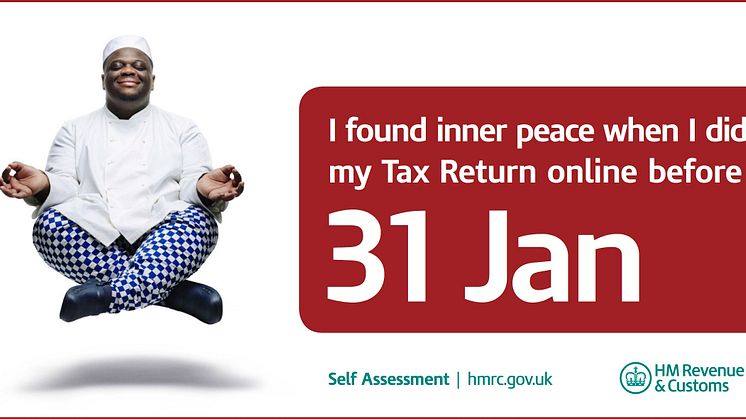

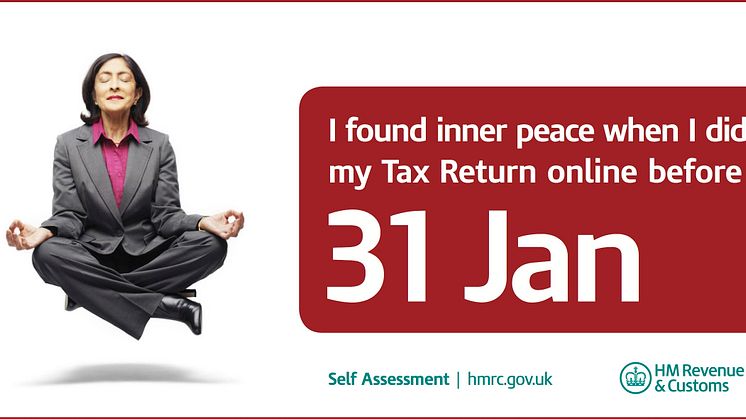

As the 31 January filing deadline is just weeks away, HM Revenue and Customs (HMRC) is calling on anyone who hasn’t sent in their 2011-12 tax return to do it now – and find “inner peace”.

While millions of people were exchanging presents, feasting on turkey, and nodding off in front of the television, 1,548 people decided to take time out from the yuletide festivities and do their tax return online – a 40 per cent increase on Christmas Day 2011, when 1,100 people filed online.

New rules that will lift the administration burden for charities claiming Gift Aid on the proceeds of donors’ goods sold by charity shops have been announced by HM Revenue and Customs (HMRC).

A new HM Revenue & Customs (HMRC) advertising campaign is urging anyone who hasn’t sent in their 2011-12 tax return to do it now – and find “inner peace”.

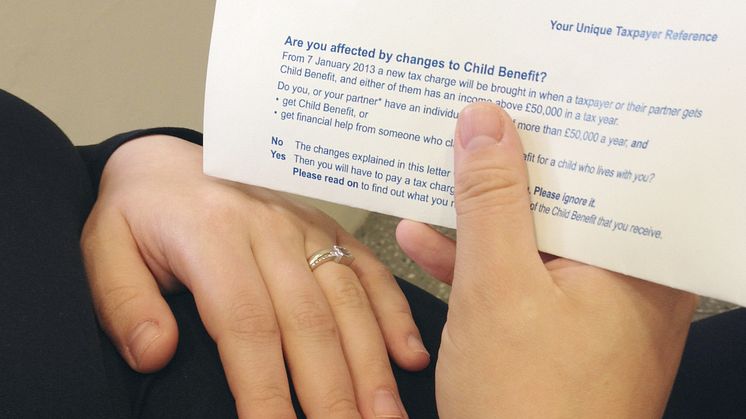

High-earning child benefit recipients have a month to decide whether to stop receiving the benefit or to pay a charge on it through Self Assessment.

HM Revenue & Customs (HMRC) is issuing a call to all Self Assessment newcomers preparing to send a tax return online for the first time – make sure you register for HMRC’s online services well in advance, so you have plenty of time to file your return.

HM Revenue and Customs (HMRC) has published guidance on penalties for late and inaccurate returns submitted in real time (RTI).

HM Revenue & Customs (HMRC) has produced a video on YouTube explaining the Patent Box, a new tax incentive designed to encourage companies to develop innovative products.

Small and medium-sized companies are being invited to a series of one-day workshops around the country on government support for business R&D and innovation. The free workshops are for SMEs and their professional advisors.

The first taskforces to tackle tax cheats in the rag trade and alcohol industry were launched today by HM Revenue & Customs (HMRC).

A marketed tax avoidance scheme which claimed to license newspaper mastheads to avoid tax has been successfully challenged by HM Revenue and Customs (HMRC) in court.

UK residents with Swiss bank accounts are to be warned that new landmark taxation arrangements are scheduled to come into force on 1 January next year.

The winners of HM Revenue & Customs’ (HMRC) External Engagement Awards 2012 have been announced.

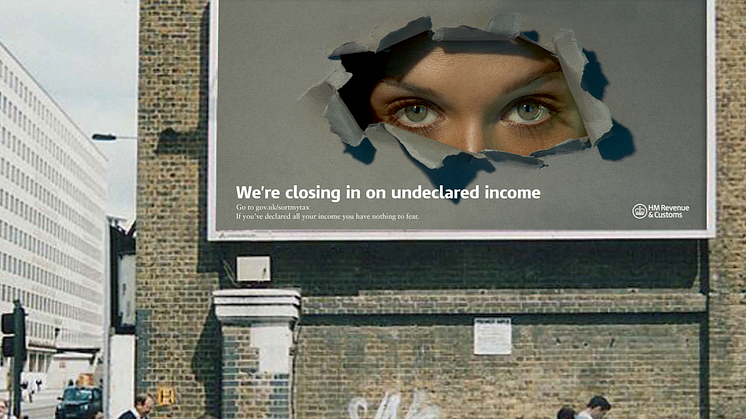

An advertising campaign warning tax cheats to declare all their income before it is too late was launched today by HM Revenue & Customs (HMRC).

Up to 250,000 employers are set to join the Real Time Information in PAYE (RTI) pilot between now and 31 March 2013.

Business Records Checks are being re-launched by HM Revenue and Customs (HMRC) today, following a review and extensive stakeholder consultation.

If you haven’t yet sent in your 2011/12 tax return, you must send it online if you want to avoid a penalty, as the 31 October deadline for paper returns has now passed.