Let’s talk about tax with the HMRC app

HM Revenue and Customs (HMRC) is encouraging families to start financial discussions and use the HMRC app during Talk Money Week (3 to 7 November) as it reveals its most popular app services.

HM Revenue and Customs (HMRC) is encouraging families to start financial discussions and use the HMRC app during Talk Money Week (3 to 7 November) as it reveals its most popular app services.

Help to Save customers have received more than £220 million in bonus payments, and HM Revenue and Customs (HMRC) is encouraging those eligible to sign up to take advantage of the scheme during UK Savings Week (22-26 September).

Around 730,000 tax credits customers will start receiving their annual renewal notices from this week.

Around 700,000 families, who receive tax credits and no other qualifying benefits, will receive their £299 Cost of Living Payment from today, 16 February 2024, to help with everyday costs.

HM Revenue and Customs (HMRC) is making the payments to eligible tax credits customers across the UK between 16 and 22 February 2024.

More than 7 million eligible UK households have already received the

Around 840,000 families, who receive tax credits and no other qualifying benefits, will receive their £300 autumn Cost of Living Payment from today, to help with everyday costs.

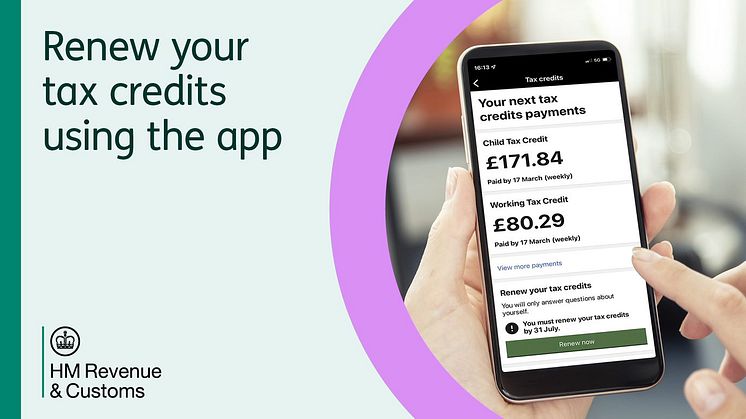

Almost 28,000 customers have used the HMRC app to renew their annual tax credits claim, HM Revenue and Customs (HMRC) can reveal.

Tax credits customers have a month to renew their claim or risk having their payments stopped, HM Revenue and Customs (HMRC) has warned.

Tax credit claimants should be on their guard against fraudsters, as HM Revenue and Customs (HMRC) warns of the latest tactics being employed by scammers.

HMRC has issued a new alert, providing details of a number of new scams reported that aim to trick people into handing over money or personal information. Criminals use deadlines – like the tax credits renewal deadline on 31 July – to target

HM Revenue and Customs (HMRC) will issue 1.5 million annual tax credits renewal packs for the 2023 to 2024 tax year to customers between 2 May and 15 June 2023.

One million eligible claimant families receiving tax credits, and no other means-tested benefits, will get the first 2023-24 Cost of Living Payment from Tuesday 2 May 2023, HM Revenue and Customs (HMRC) has confirmed.

More than one million claimant families receiving tax credits, and no other means-tested benefits, will get their second Cost of Living Payment from Wednesday 23 November 2022, HM Revenue and Customs (HMRC) has confirmed.

Around 1.1 million claimant families receiving tax credits will get their first Cost of Living Payment from Friday 2 September 2022, HM Revenue and Customs (HMRC) has confirmed.

This £326 government payment will be paid automatically into eligible tax credit-only customers’ bank accounts between 2 and 7 September 2022. The first HMRC payments will total around £360 million.

Nadhim Zahawi, C

With just over a week to go, HM Revenue and Customs (HMRC) is urging more than 222,600 tax credits customers to renew their claims before the 31 July deadline.

Customers are being warned not to leave their renewal until the last minute and risk their payments being stopped. They can do it any time - day or night - through HMRC’s online services, including the HMRC App.

Tax credits help work

More than 33,600 customers have successfully used the HMRC app to renew their tax credits claim so far this year, a 39% increase on last year, HM Revenue and Customs (HMRC) has revealed

323,700 customers are yet to renew their tax credits ahead of the deadline, with HM Revenue and Customs (HMRC) reminding them to do so by 31 July – or their payments will stop.

Tax credits help working families with targeted financial support – so it’s important that customers renew before the deadline to ensure they don’t miss out on money they’re entitled to.

Customers can renew their tax

HM Revenue and Customs (HMRC) is reminding thousands of parents and families not to miss out on financial support that can help pay for childcare during the summer holidays.

HM Revenue and Customs (HMRC) is warning tax credits customers to be aware of scams and fraudsters who imitate the department in an attempt to steal their personal information or money.

About 2.1 million tax credits customers are expected to renew their annual claims by 31 July 2022 and could be more susceptible to the tactics used by criminals who mimic government messages to make them appear

HM Revenue and Customs (HMRC) is warning Post Office card account holders, who receive HMRC-related payments, that time is running out – with just two weeks left to switch their accounts.

HM Revenue and Customs (HMRC) is reminding about 7,500 tax credits, Child Benefit and Guardian’s Allowance customers they have just one month left to switch their Post Office card account.

HMRC will stop making payments to Post Office card accounts after 5 April 2022 so customers must notify HMRC of their new account details, so they don’t miss out on vital payments.

In November 2021, HMRC e

From 1 December 2021, HM Revenue and Customs (HMRC) will stop making payments of Child Benefit, Guardian’s Allowance and tax credits, into Post Office card accounts.