Press release -

Top 10 tax credits renewal ‘excuses’ revealed

With the tax credits renewal deadline of 31 July just over two weeks away, HM Revenue and Customs (HMRC) has revealed the top 10 excuses for not renewing tax credits claims.

Excuses given by claimants to HMRC for missing the deadline include:

1. I didn’t need the money because I’d met a rich bloke, but he dumped me

2. My mum usually does this for me

3. The form was locked in the boot of my car, and then my car caught fire

4. My baby used the paperwork as a colouring book

5. My dog ate the form

6. I got confused with the 31 January Self Assessment deadline

7. I booked the last two weeks of July for a holiday and forgot all about it

8. I’ve been in hospital but am feeling much better now

9. I was unable to get income details from my employers in time

10. I thought I’d already renewed

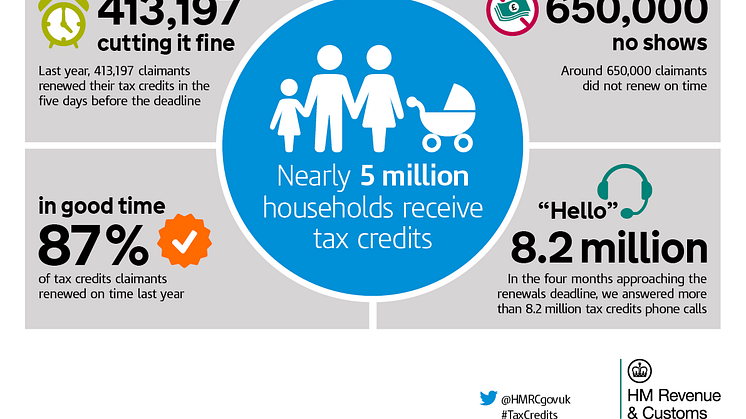

Claimants have until the 31 July deadline to renew, or their payments might end. Last year more than 650,000 failed to renew on time. This year, for the first time, claimants can renew online, at GOV.UK, as well as being able to renew by post and phone.

Nick Lodge, Director General of Benefits and Credits, HMRC, said:

“So far, over 203,000 claimants have renewed online. It’s a quick and easy way to do it.

“Renewing tax credits on time is important. People who don't renew by the deadline can, and do, lose their payments.”

HMRC asks all claimants to check the accuracy of the information in their renewals pack, and to tell the department about any changes to their circumstances that they haven’t already reported, such as to their working hours, childcare costs or pay.

Notes for editors

1. Over 5.8 million tax credits renewal packs were sent to claimants between April and June. Claimants are asked to act as soon as they receive a pack. Last year, more than 87 per cent of claimants renewed by the deadline.

2. Claimants can get help and information on tax credits renewals from: website: gov.uk/browse/benefits/tax-credits telephone: Tax Credits helpline – 0345 300 3900

3. A free HMRC app is available in the iTunes and Google Play stores.

4. Follow the tax credits renewals conversation on Twitter using #TaxCredits and #RenewNow.

5. Follow HMRC’s press office on Twitter @HMRCpressoffice

6. HMRC’s flickr channel www.flickr.com/hmrcgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.