Press release -

HMRC make it an ‘appy New Year for jobseekers

With the New Year a popular time to change job, those seeking a career change can join the 1.2 million people a month already saving precious time with an essential app download for 2024.

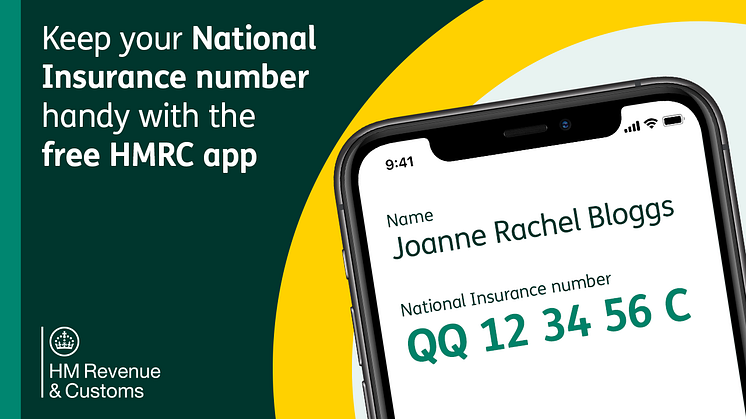

The HMRC app which was opened over 80 million times in 2023, allows people to quickly find their employment history and National Insurance number to pass on to a new employer. They can even save their National Insurance number to their digital wallet on their phone – making it nice and handy when applying for or starting a new job.

With just a few taps, customers have downloaded their employment details almost 200,000 times via the app during 2023. However, HMRC still receives around three million calls a year, with people waiting on hold for information they could quickly access digitally at a time and place to suit them.

During January, when HMRC’s helpline experiences a surge in enquiries about employment history, HMRC is encouraging customers to download the free and easy to use HMRC app instead, which provides secure access to personal tax affairs, saving an unnecessary phone call and a potential long wait listening to hold music.

Nigel Huddleston MP, Financial Secretary to the Treasury, said:

“When people apply for a job the last thing they want to be doing is wasting time on the phone to HMRC to find their National Insurance number or tax code, which is why I encourage job-seekers to save themselves effort in the future and join 1.2 million monthly users and start using HMRC’s fantastic app.”

Myrtle Lloyd, HMRC's Director General of Customer Services, added:

"With the new year bringing new opportunities and career aspirations for many, our app is a great way to securely access your tax code, National Insurance number, and employment details - information a new employer may ask for. A few taps will save you a call and the information is accessible at any time."

App users will need to create an account or sign in if they already have one to access their personal information. If you need to set up an account, the app will guide you through the process.

The app can be used to access income and employment history, salary information, National Insurance number, tax code, and more whenever it’s needed. You can quickly download and print much of this information through the app within seconds, eliminating the need to call HMRC to ask for it or to be sent in the post.

Notes to Editors

1. More information about the HMRC app.

2. People can download the app at the [App Store] or [Google Play]. Online reviews indicate plenty of satisfaction with the app’s performance, as it currently holds a score of [4.8] stars on the App Store, and [4.7] on Google Play.

3. Once a customer has signed into the app for the first time, they can use facial recognition, their fingerprint or a 6-digit pin to get fast and secure access.

4. Customers who don’t have a Government Gateway user ID and password will need two forms of evidence to prove their identity. This can include their UK passport and UK driving licence.

5. We’re urging customers never to share their Government Gateway user ID and password. Someone using these details could steal from them or make a fraudulent claim in their name.

6. App users can also benefit from other functions on the app. These include:

- checking their payments from their employer

- registering for Self Assessment

- making a Self Assessment payment

- reporting tax credits changes and completing renewals

- accessing their Help to Save account

- Using HMRC’s tax calculator to work out their take home pay after Income Tax and National Insurance deductions

- tracking forms and letters they have sent to us

- claiming a refund if they have paid too much tax

- updating their address

7. The app is compatible with built-in accessibility functions on a customer’s smartphone including:

- invert colours and adjust contrast levels

- increase the text size without the text truncating or overlapping

- navigate the app using switch control/access

- using voice activation

- listen to the app with a screen reader

- Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.