Press release -

HMRC app speeds up student loan applications

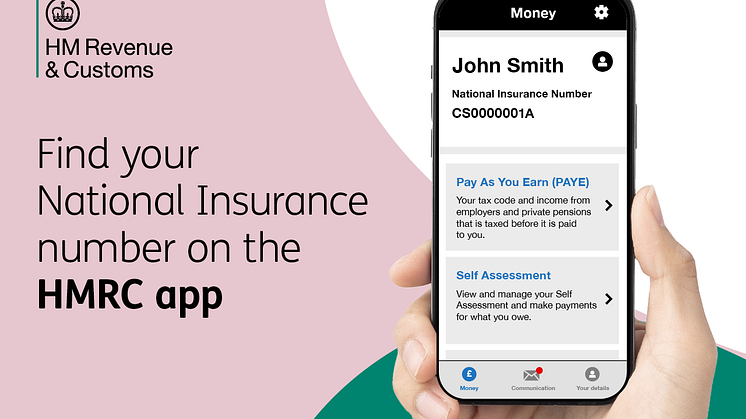

With many A level students planning their next steps in life, those starting university in September can ‘tap the app’ to get National Insurance and tax information they need to complete their student finance applications, HM Revenue and Customs (HMRC) has said.

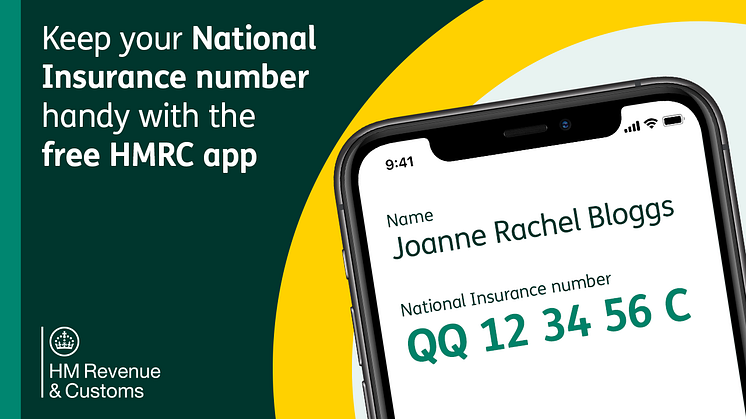

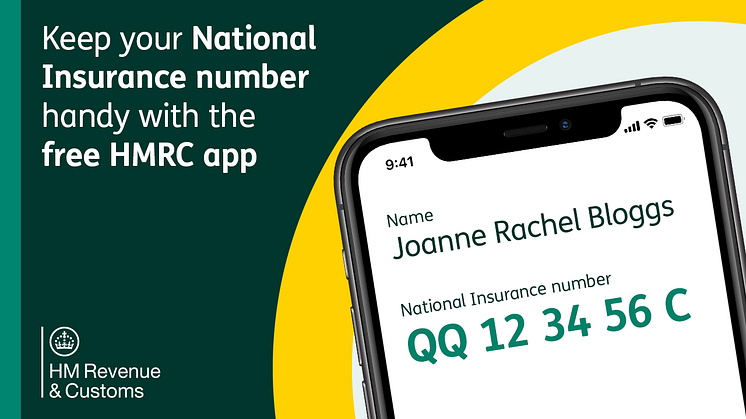

Anyone applying for a student loan for the 2024/25 academic year is encouraged to start their application now and to get the essential details they need, including their National Insurance (NI) number, quickly and easily via the HMRC app.

HMRC data shows that in the 12 months to March 2024, more than 112,000 customers called the National Insurance Helpline asking for a lost or forgotten NI number of which nearly 50% were from customers aged between 16 and 20. It also shows May was the busiest month with more than 6,400 young people calling the helpline for their NI number, coinciding with students applying for their student loans.

HMRC has produced a video to encourage students to save time by downloading the free and easy to use HMRC app for instant access to the details they need.

Suzanne Newton, HMRC's Director General for Change Delivery said:

“Getting your NI number is simple with a tap of HMRC’s app and young people should take advantage of it. Download the HMRC app today straight from your phone’s app store to get all the info you need quickly and easily.”

As well as their NI number, students applying for finance will also need:

- a working email address

- a bank account in their own name

- a valid UK passport

- course details

Students can also apply for finance to help with cost of living expenses. How much they receive is dependent on household income – as well as where they live while they study. Parents or the partner of students will also need to have their NI number to hand. Visit GOV.UK for more information.

Any details missing from an application could cause a delay and may mean a delay in receiving any loan payments in time for the start of the students’ course so it’s important to keep essential details to hand.

Bill Watkin, Chief Executive of the Sixth Form Colleges Association said:

“Downloading details from the HMRC app will speed up the process of applying for a student loan. Preparing for higher education can be a time-consuming process for sixth form students so we are pleased this will help to reduce the administrative burden on young people.”

Searching for NI information is one of the most popular searches on the HMRC app with almost 900,000 views in the last year and more than 430,000 National Insurance card downloads to customers’ digital wallets. It is available and easy to access whenever they need it.

Notes to Editors

1. In England, for more information on student finance and to check that you’re ready to apply go to: https://studentfinance.campaign.gov.uk/student-toolkit/

- In Wales go to www.studentfinancewales.co.uk/

- In Scotland go to www.sass.gov.uk

- in Northern Ireland go to www.studentfinanceni.co.uk

2. More information about the HMRC app.

3. People can download the app at the [App Store] or [Google Play]. Online reviews indicate plenty of satisfaction with the app’s performance, as it currently holds a score of [4.8] stars on the App Store, and [4.7] on Google Play.

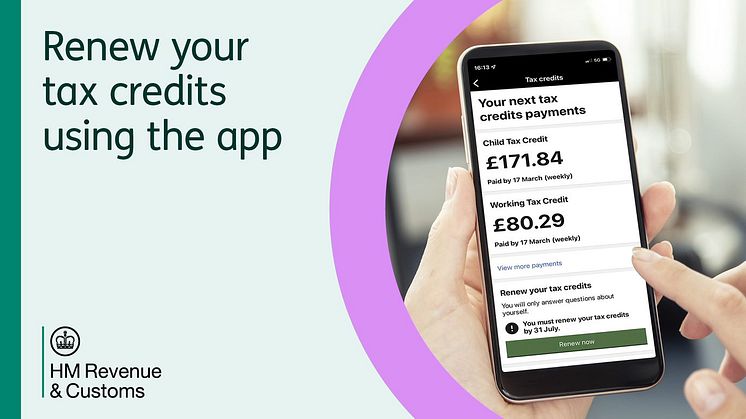

4. App users will need to create a Government Gateway account or sign in if they already have one to access their personal information.

5. The app can be used to access income and employment history, salary information, National Insurance number, tax code, and more whenever it’s needed. You can quickly download and print much of this information through the app within seconds, eliminating the need to call HMRC to ask for it or to be sent in the post.

6. Once a customer has signed into the app for the first time, they can use facial recognition, their fingerprint or a 6-digit pin to get fast and secure access.

7. Customers who don’t have a Government Gateway user ID and password will need two forms of evidence to prove their identity. This can include their UK passport and UK driving licence.

8. We’re urging customers never to share their Government Gateway user ID and password. Someone using these details could steal from them or make a fraudulent claim in their name.

9. Follow HMRC’s Press Office on X @HMRCpressoffice

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.